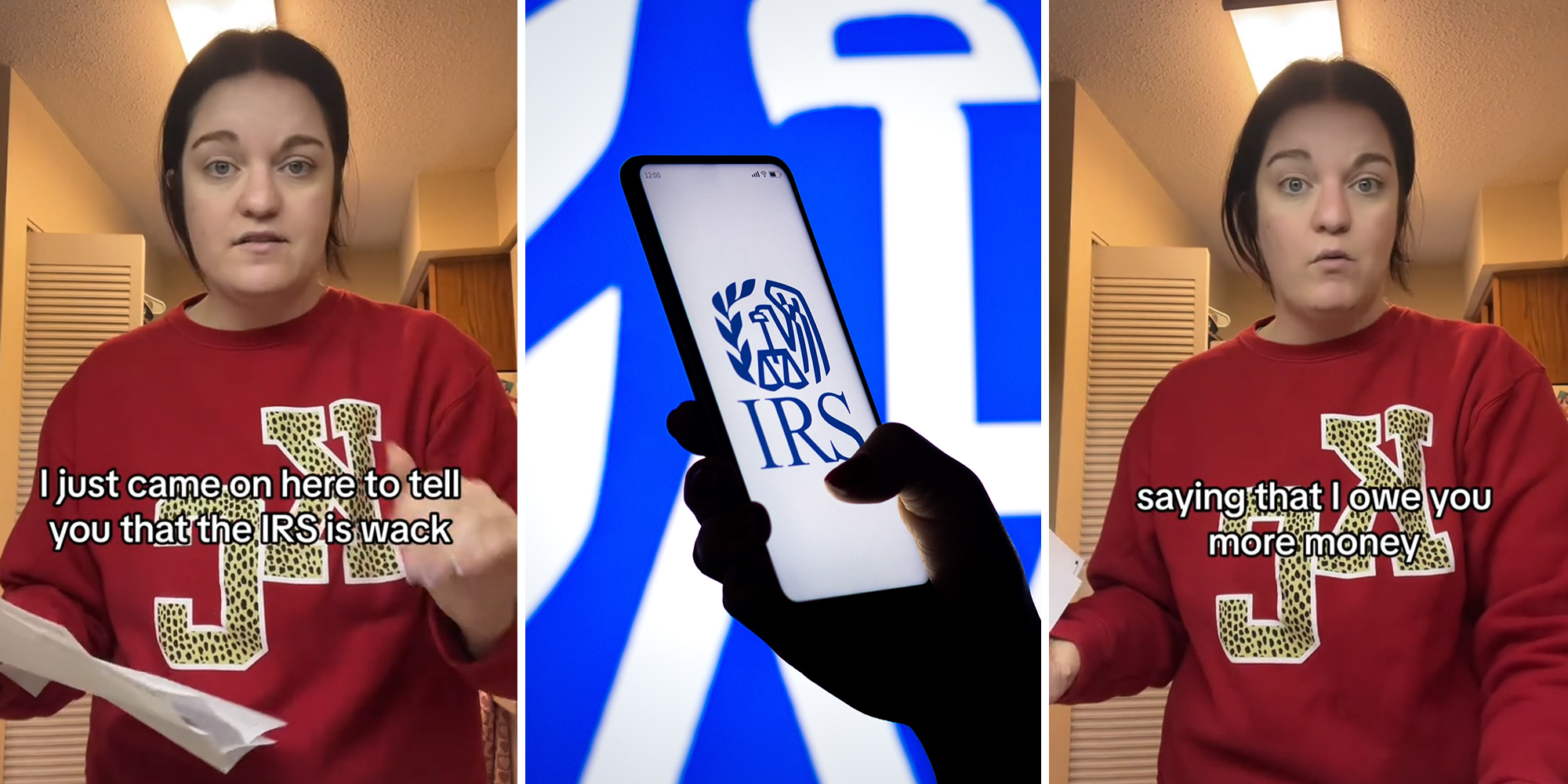

A woman trying to sort out a tax bill from the Internal Revenue Service (IRS) dating back to 2019 is furious that she's received notice of an interest charge five years later.

In a video that's garnered more than 516,900 views since going up on Saturday, TikTok creator Nic (@petty_netti) began by saying, "I just came on here to tell you that the IRS is wack."

She claims, "Every time I pay off my 2019 tax bill, y'all come and send me another bill for more money, saying that I owe you more money."

She also says she's been calling the IRS to determine why she still owes, but none of the employees she's encountered can sufficiently do that.

"You're telling me that I owe $2,000, but $500 of that is interest all the way back to 2019," Nic says.

Then, revealing the reason for her frustration, she queries, "You're charging interest on a bill that was supposed to be paid in 2019 that you just sent me on January 8, 2024? How does that make sense?"

@petty_netti Im so sick of the dang IRS #divorceglowup #growth

♬ original sound - Nic

According to the IRS website, "The IRS charges underpayment interest when you don't pay your tax, penalties, additions to tax or interest by the due date. The underpayment interest applies even if you file an extension."

The site adds, "In general, we charge interest on underpayments starting on the due date of the amount you owe and will continue to accrue until the balance is paid in full."

The IRS has been working on its customer service reputation in the past year. An AP story from last April revealed that "answering taxpayers' phone calls promptly" was one of the improvements in store from a $80 billion budget infusion through fiscal year 2031. The plan involves the agency improving its operations by "pledging to invest in new technology, hire more customer service representatives and expand its ability to audit high-wealth taxpayers."

Nic recorded a follow-up video, drawing nearly 450,000 views, claiming that the IRS plays "the transfer game" with customers, in which employees transfer callers from one person to another until they hang up in frustration.

@petty_netti Put me on the phone with whoever is in charge please and thanks. #irs #taxes2024 #accountant #joebiden

♬ original sound - Nic

Nic's two videos and the comments that followed indicate the IRS has more work to do to improve perceptions of its customer service.

"The IRS owed me money from a 2020 tax return which they paid 2 yrs later but they refused to pay ME the interest for the 2 years it took me to get it straightened out," one commenter said on the original video.

Another asked, "Are these bills scams? Because it seems like people are getting the same exact bills and they don't know why."

A number of commenters advised Nic to work with a tax attorney or a certified public accountant to try to resolve the issue with the IRS.

"As someone who works in taxes, they don't know what anyone owes," another commenter asserted. "Always send proof back with that letter you paid."

The Daily Dot has reached out to the creator via TikTok comment.