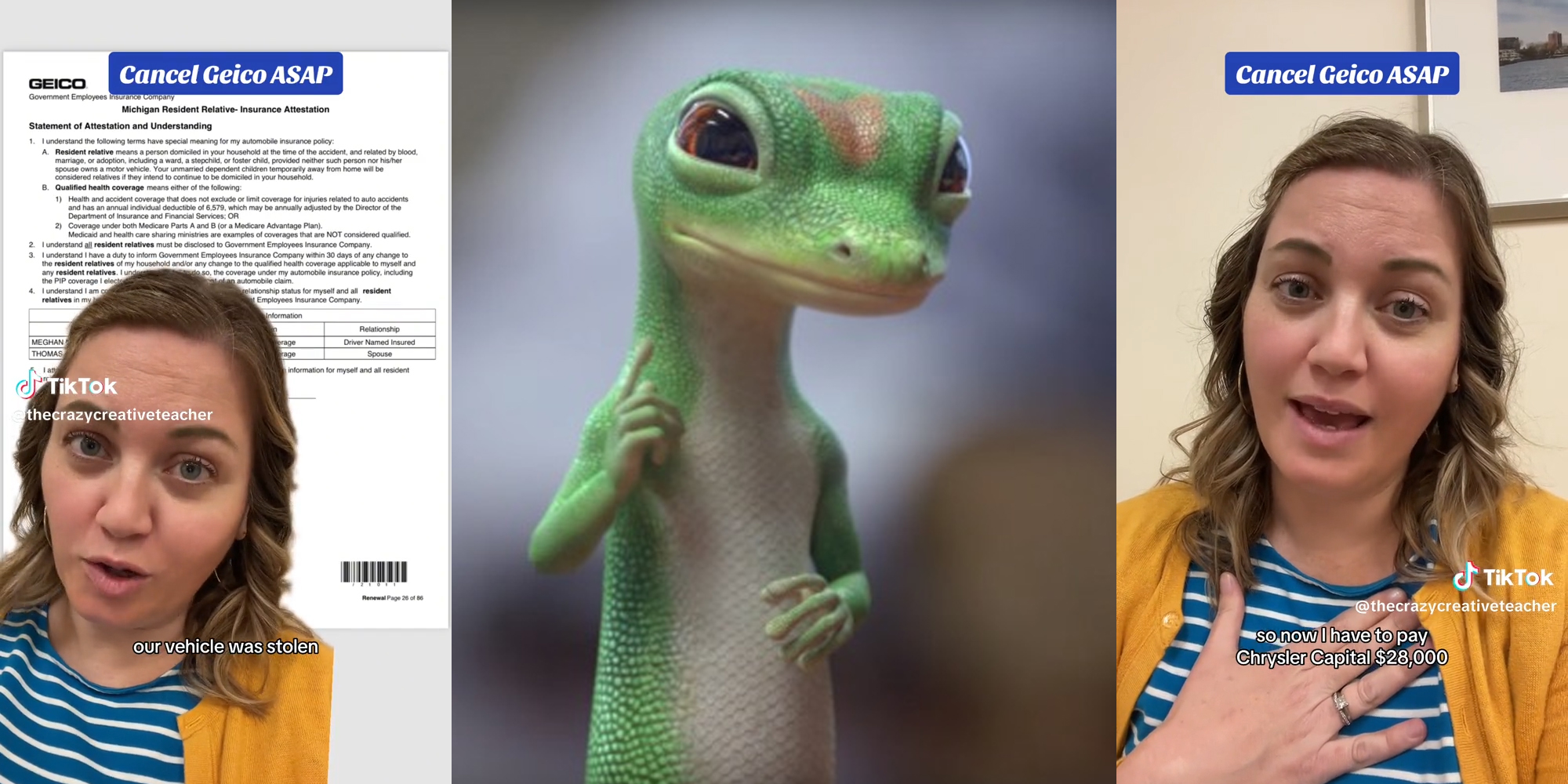

An internet user is calling out Geico after accusing the insurance company of unethical business practices.

In a clip with over 262,000 views, TikTok user Meghan Mayer (@thecrazycreativeteacher) says that her car was stolen on March 31. When she filed a claim with Geico, the company allegedly refused to compensate her, claiming that she did not add her children to a certain form required by the state of Michigan.

The problem? Mayer says she has never seen, nor signed, such a form.

“I switched from Florida to Michigan, and when I did that process, this form never came up. I also never signed it,” she says. She later adds, “They are saying that because I didn't add my children to this form, that I misrepresented myself, and that they would have charged me a higher premium or not covered me at all had they known that I had two children.”

As a result, Mayer says that Geico “backtracked” her coverage to March 3, 2024, before her vehicle was stolen.

“So now I have to pay Chrysler Capital $28,000 on top of everything else that we're going through with my daughter in the hospital,” she states.

To conclude, she advises that users do not use Geico and says that she will be taking legal action against the company.

@thecrazycreativeteacher @GEICO I was a loyal customer for over 10 years and had one minor claim before this when a piece of metal hit our car on the highway. I will not stop sharing what you’re doing to my family, especially during the hardest experience of our lives. I hope denying our claim is worth all the bad PR.

♬ original sound - Meghan Mayer

In a follow-up video, Mayer provides additional information about her issue.

In this clip, Mayer says that, after reporting the theft, the company was initially very helpful, saying that she has full coverage and that they would pay for her rental car. Things changed around two weeks later.

“They call me all nice and sweet—’Just want to confirm who lives in your house.’ ‘Well, sure, no problem. It's my husband and I, my 10-year-old, and my 7-year-old,’ and that's when the entire tone changed,” she recounts. “‘Oh, well, did you know that you didn't put them on this form that's specific to the state of Michigan, that there's a law in the state of Michigan that you have to add everyone in your household to this form?’”

“Well, no, I wasn't aware of that, because I just moved from Florida to Michigan this past summer, and when I changed my coverage to be covered in Michigan, all I did was I went to the app, I changed my address. I made sure my coverage was the same and that was it,” she continues. “There were no specific forms that popped up that had to do with Michigan. I was never sent any specific forms that had to do with the State of Michigan. And in fact, when my policy auto renewed in January, I still was not sent any forms that were specific to the state of Michigan.”

“So because I didn't fill this form out that I was never given, that I've literally never seen until they brought it to my attention during this claim, they're saying that I misrepresented myself,” she says.

Mayer proceeded to question the legality of this practice, saying that, if she was truly not supposed to be covered, it would make more sense that the company backdate her entire coverage, not just the coverage leading up to the month before the theft.

While she says she’s already filed a complaint with the state of Michigan and secured an attorney, she further shares that she expects more from the company.

“I will not sleep until I hear personally from, like, the CEO of this company,” she declares. “Fine, deny my claim. Then give me a check for $28,000. Like, that's literally what you can do right now to make me stop posting about your company.”

@thecrazycreativeteacher I can’t be angry at anyone or anything for what has happened to Kennedy, so thank you @GEICO for giving me something to take out all of my rage on. #geico #geicoinsurance #carinsurance #fyp #foryou #foryoupage

♬ original sound - Meghan Mayer

In the comments section, users said that, while Michigan has different auto insurance policies to many other states, the company’s reaction was both confusing and disappointing.

“MI car insurance is reeeaaalllly different than almost every other state. I’d get an agent,” said a user.

“I work in insurance and we’ve never cancelled for that MI insurance form,” offered another.

“If that’s a required form, it’s on them to make sure you filled it out ???” questioned a third.

“It’s common in MI to list your children with auto insurance because of the no fault law. It has to do with PIP coverage,” noted a further TikToker.

The Daily Dot reached out to Geico and Mayer via email.

The internet is chaotic—but we’ll break it down for you in one daily email. Sign up for the Daily Dot’s web_crawlr newsletter here to get the best (and worst) of the internet straight into your inbox.