Most people wouldn’t start a tax company after being associated with one of the most spectacular frauds of the century.

Ja Rule isn’t like most people.

The rapper surged out of the relative anonymity last year as a central player in the 2017 Fyre Festival musical festival debacle which was immortalized in two competing documentaries from Netflix and Hulu.

Not content to drift back into nostalgic obscurity, Ja Rule returned to the public eye on Tuesday with another suspect business proposition: Ja Rule is getting into the tax game.

It’s TAX SEASON!!! And we’re giving you $100 when you walk in the door!!! let us do your taxes walk out with $100 it’s that simple!!! Not in Jersey no problem give use a call… 973.732.9104 Value Tax 810 Clinton ave… https://t.co/eLJGLbxVPX

— Ja Rule (@jarule) January 12, 2020

It turns out that Fyre Festival isn’t the only curious business opportunity the rapper turned entrepreneur will try to foist on the public. Rule is now touting Value Tax, a tax preparation company of which he is the proud owner.

Before the Fyre Festival debacle, Ja Rule famously served a 28-month prison sentence for tax evasion in 2011 and his IRS troubles reportedly persist to this day. Some might argue that all of this experience with the wrong side of tax law makes him the ideal spokesman for such an endeavor. Twitter clearly disagrees.

https://twitter.com/AvinashTharoor/status/1217186170322522113

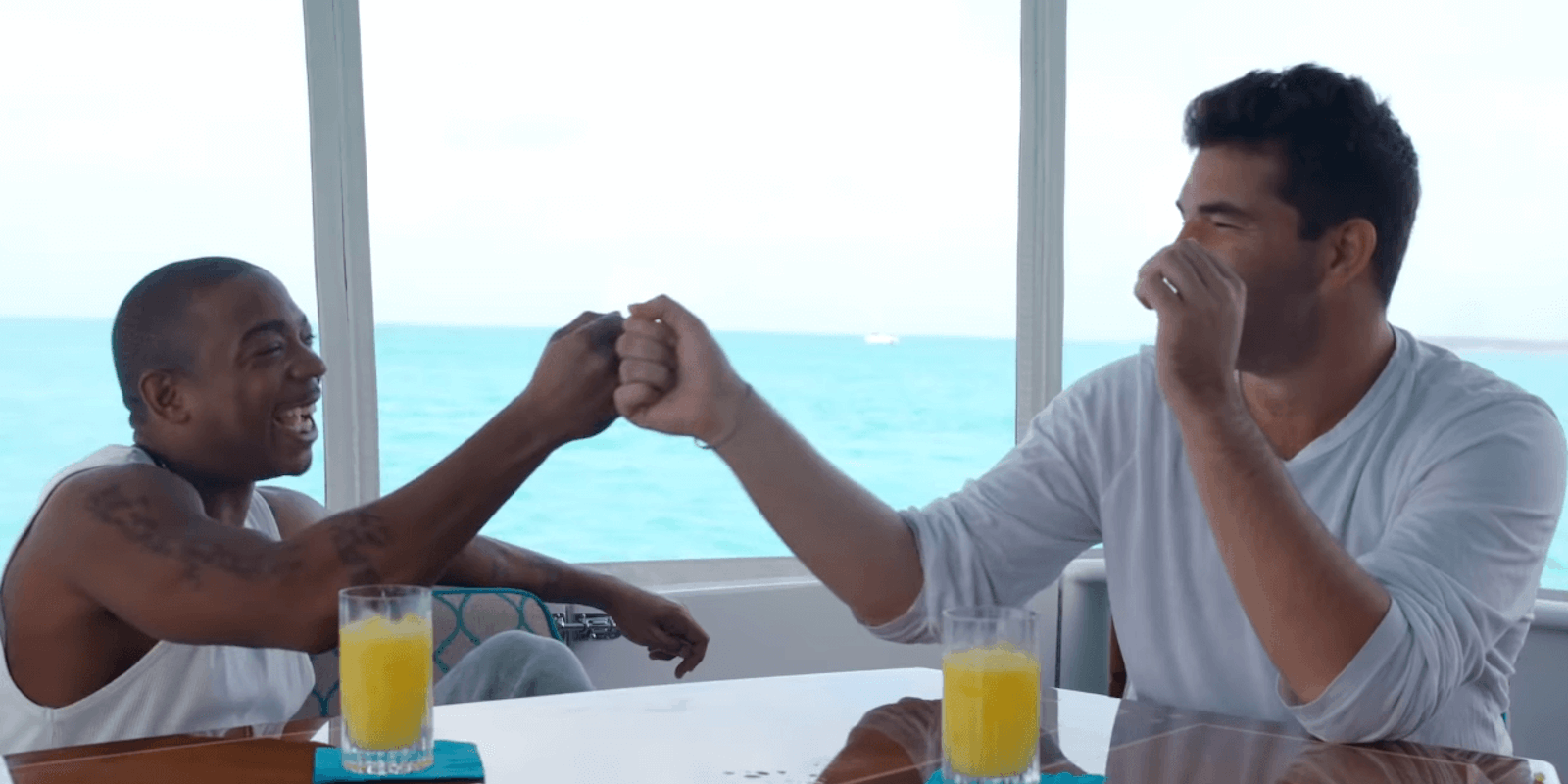

Complimentary lunch you get when Ja Rule sits down with you to do your taxes pic.twitter.com/9836derint

— Lancestipher (@Lancestipher) January 15, 2020

Twitter criticism derailed what was meant to be a week of promoting Value Tax online for Ja Rule. Social media had discovered his promotional tweets from Jan. 11 and 12 by Monday and as of press time, the rapper had posted 18 tweets defending himself in addition to a number of since-deleted tweets caught by outlets like Complex and Ad Age.

https://twitter.com/jarule/status/1217225838543896577

As of Wednesday morning, Ja Rule had stopped engaging with the haters following one last salty tweet Tuesday night.

https://twitter.com/jarule/status/1217291509139214339?s=20

But, if we know Ja Rule, we know he won’t stay silent for long. So long as there is a shady business to promote, Ja Rule won’t be far behind.

READ MORE:

- Ja Rule thinks he was also a victim of Fyre Fest

- Ja Rule compares Fyre Festival to the Titanic—and thinks that’s a good thing