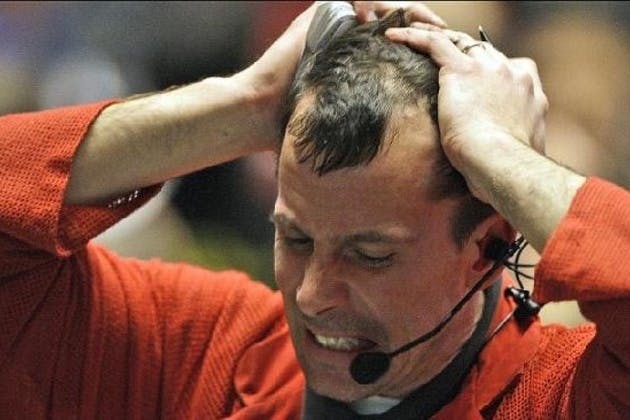

Things are looking good for the stock market. Really good. Just last week, the Dow Jones Industrial Average hit an all time high, capping out at 14253.77. The S&P Volatility Index—sometimes called the “fear index”—is at its lowest point since before the crash. What we see is a market that’s growing and stable.

So you know what that means. It’s time for scammers and gullible investors to start burning the whole thing down again.

The latest scam relies on Twitter, which, Reuters notes, has “become an important source of information for many investors.” It works like this: Someone gets on Twitter, creates a fake account the people think belongs to some insider investor or executive who might know when a stock is about to blow up or tank. People who are stupid enough to believe everything the read on Twitter freak out and blow up or tank that stock. A lot of people are stupid, so it’s a problem.

Think of it like that time the internet believed Tony Danza had died because Twitter said so—specifically, by having fallen off a 60-foot cliff in New Zealand. Except in this case, Tony Danza is your life savings, and the cliff is your broker’s IQ.

In what should seem like a point that doesn’t need belaboring, Reuters notes that the “massive declines” that happen when panicked investors sell their stocks based on info from a bunk Twitter account show “how the rapid spread of information on social media can make for volatile trading, and is a warning to investors who trade on news before fully verifying the source.”

Unfortunately, it’s a point that bears repeating. Perhaps investors simply forget how easy it is to set up a fake Twitter account when they’re playing with other people’s money. Or perhaps they really are that tweaked out and gullible. As such, the FBI has to hold brokers’ hands to remind them not to believe everything they read:

The FBI monitors Facebook and Twitter, and told Reuters in November that social media will be a big part of securities fraud. The U.S. Securities and Exchange Commission’s website has a warning that swindlers can use social media “to appear legitimate, to hide behind anonymity, and to reach many people at low cost.” And the Financial Industry Regulatory Authority has issued social media guidelines to broker-dealers, requiring that they keep records of usage.

Scammers are scammers. What they do is reprehensible. But they’re nothing new. Brokers can do a few things to at least check their sources before freaking out. Setting up a fake Twitter account is something anyone can do any time, any where, and tools like Status People’s Fake Follower Check can help a person do a little digging into how many followers a Twitter account has are fake. Deep breaths, people.

By Austin Considine // Photo via The Australian/Motherboard