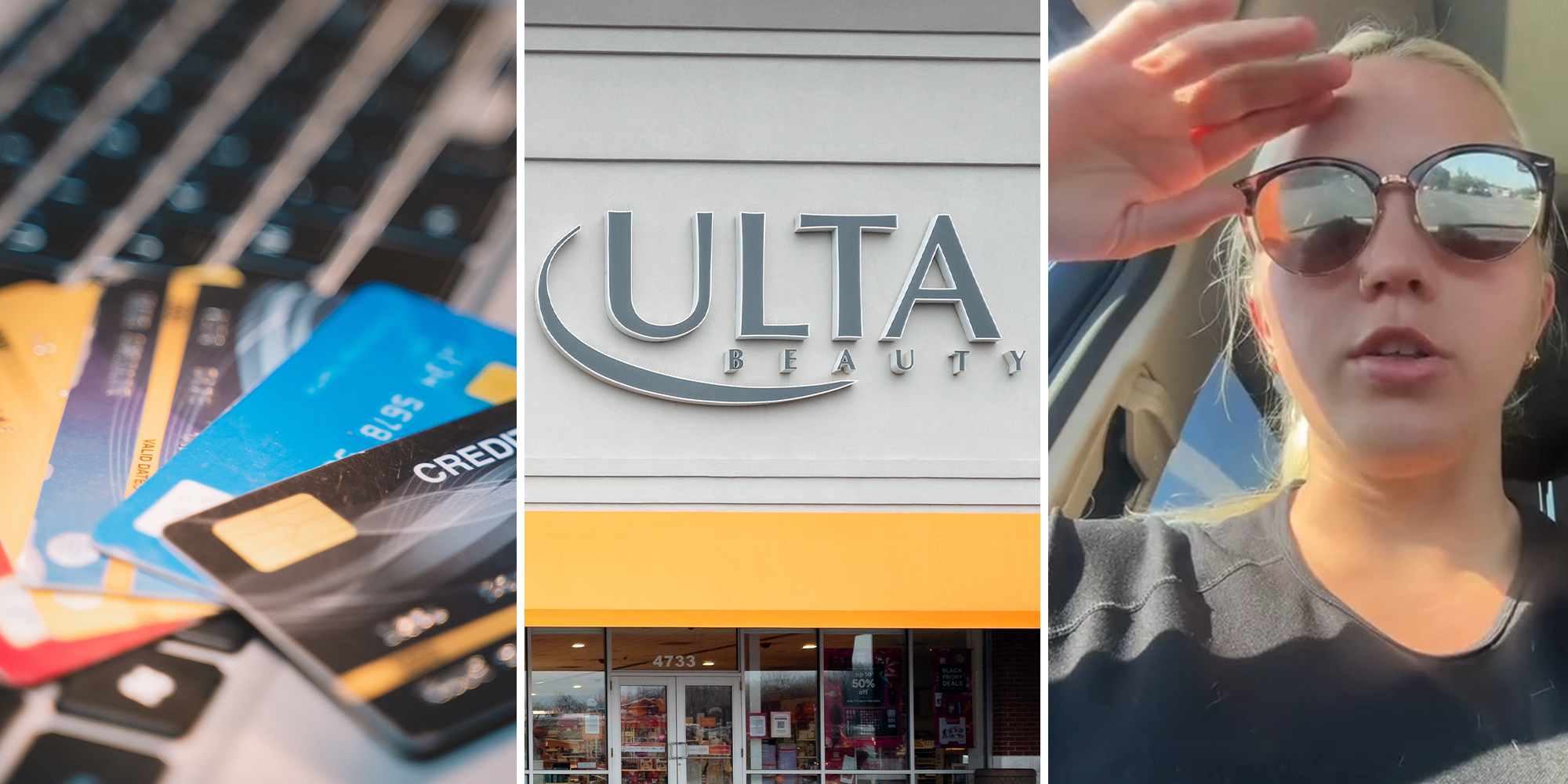

Customers think stores are getting out of hand with how much they peddle their credit cards.

It seems like just about every store—from makeup locales to clothing stores to home improvement spots—is trying to get shoppers to sign up for its store credit card.

Some stores have even been accused of using deceitful tactics. For example, workers may make you think you're signing up for a regular loyalty program vs. a real financial product with the power to impact your credit score and finances.

Most Americans are in credit card debt

About three in five Americans are in credit card debt, owing about $5,800 on average, Yahoo Finance reported. Debt can be hard to get out of, given how staggering the interest rates on many cards are. And it's not like store-branded credit cards are not known for having particularly great rates.

While a store credit card might be worth it for you, depending on the perks that come with it, you don't want to be pressured into it.

In a viral video, Ulta customer Tori (@tori.aleah) said three employees ganged up on her as they tried to convince her to get the Ulta credit card. She says one of them wasn't even on the clock. Her video has received more than 100,000 views

"What are the managers doing to you guys to get you all to keep pushing the credit card like that? Like, are they holding you at gunpoint in the back office whenever you get to work?" Tori asks.

Tori recounts that, at checkout, the cashier informed her she'd spent nearly $1,000 with them this year. The worker, Tori continues, suggested she sign up for an Ulta credit card since she was such a regular. Tori says she politely declined. But the girl, Tori says, kept pushing it. She recalls the worker telling her she "might as well" and that it was the "smart thing to do."

Tori says she declined again, stating she didn't want to mess up her credit score. Then, the girl behind her, who'd just gotten off her shift, also got on the credit card convincing train.

"Please let me know if you guys need help at Ulta. And they're forcing you guys to do this, because I know that you are not pushing this credit card of your own free will," Tori says

Ulta's credit card

As of this week, the average credit card interest rate is at 27.62%, according to Forbes. Yet, at the time of publishing, the Ulta Beauty Rewards™ Credit Card had a whopping 32.24% interest rate. This was not listed prominently on Ulta’s credit card page. We instead had to find it in the terms and conditions.

Ulta does not have the highest interest rates of any card, but they’re certainly higher than most. It is important to note that interest rates can vary based on your credit score and the market. (FYI, Ulta has multiple credit cards with varying rates and terms of use.)

Workers share the pressures they are under

In the past, retail employees have shared that they get in trouble for not reaching credit card quotas and can even get their hours reduced as punishment. This was reaffirmed by commenters.

"At old navy if you didn't get enough people to sign up for credit cards YOU got in trouble. like what? i quit after a month," a person shared.

"I worked for tjmaxx we would get written up and I swear they would schedule you less!" another said.

"I’m sure it’s different everywhere, but as a manager in a retail store who has a store credit card.. there are definitely requirements DAILY for how many people we get to sign up," a commenter wrote..

The Daily Dot reached out to Tori and Ulta for comment via email.

Internet culture is chaotic—but we’ll break it down for you in one daily email. Sign up for the Daily Dot’s web_crawlr newsletter here. You’ll get the best (and worst) of the internet straight into your inbox.