In a TikTok video that has garnered 72,000 views as of Friday, Brittney Reynolds (@brit_reynolds) brings some humor to a situation that resonates deeply with many: the balancing act of living paycheck to paycheck.

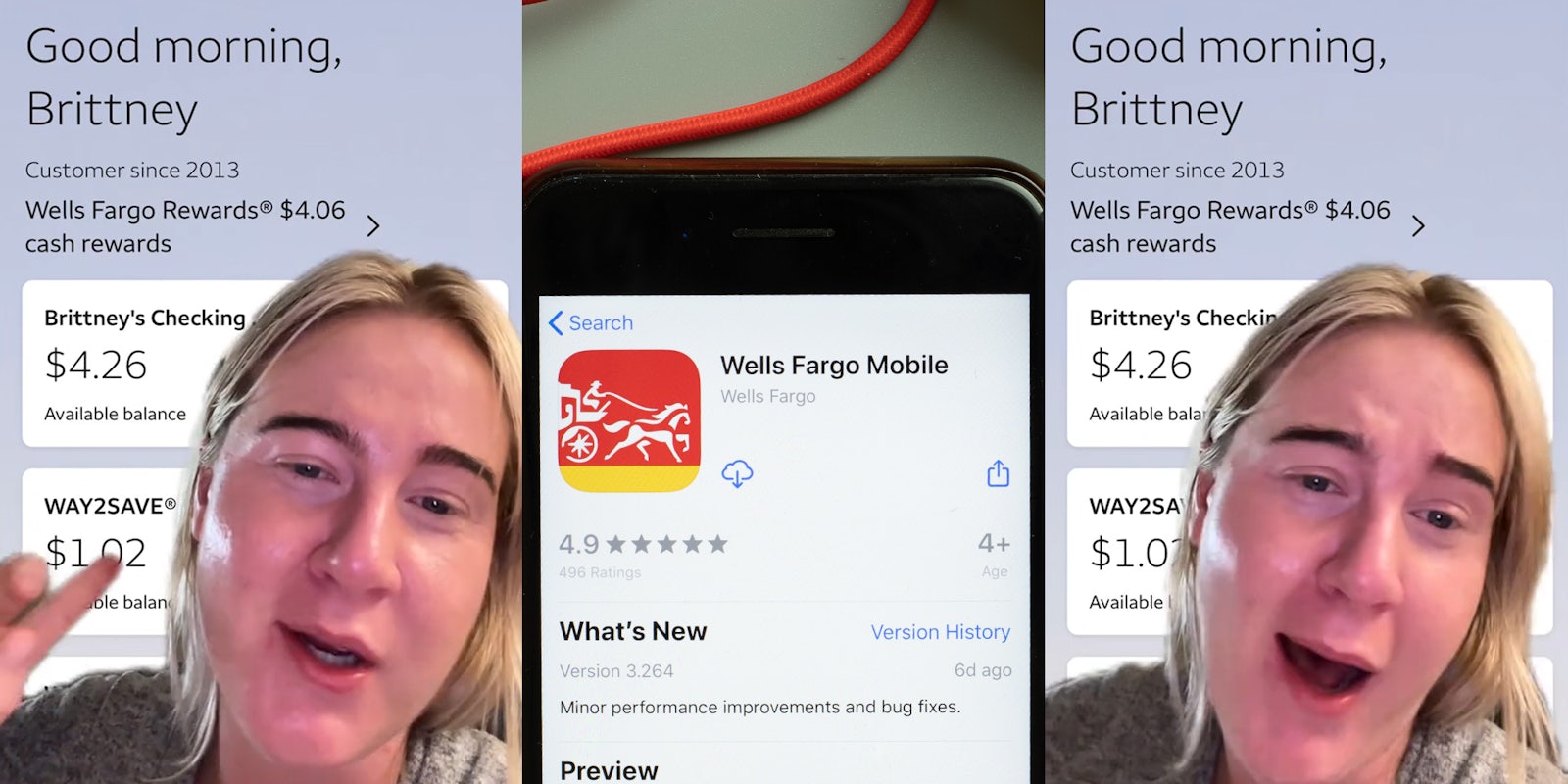

With a caption that reads, “Babe every cent counts!” and a green-screened backdrop showing her Wells Fargo bank statement, Reynolds shares a moment that is all too familiar for many Americans.

“I’m hanging on by a thread, I had $5 in my account yesterday so I checked today I was like, ‘Please don’t be negative, please don’t be negative.’ Wells Fargo has the audacity of doing a $1 automatic savings transfer from my account. Bitch, put it back! Put it back! I need that, I get paid tomorrow, OK?” Brittney narrates, her tone a blend of mocking outrage and playful resignation. This 15-second video was all too familiar with users in the comments.

The comments section quickly transformed into a collective sigh of shared experience and empathy for Renolds’ plight.

“Girl same I’m at $3 till 7am,” commiserated one user, while another shared, “$10 and I get paid SATURDAY currently not ok.”

Yet another counted down the hours, sharing, “I get paid Saturday I am counting down every hour.” As is often on TikTok, the thread became a space where humor and shared struggle coexisted, highlighting a widespread issue often hidden behind closed doors.

While Brittney’s video brings a chuckle and a moment of relatability to many, it also shines a light on a larger, pervasive issue: The financial tightrope that many Americans navigate daily. The irony of an automatic savings transfer, a tool designed to assist in financial management, becoming a source of stress for those barely making ends meet, is not lost on most Americans.

@brit_reynolds #greenscreen babe every cent counts !!!! #debtpayoff #ccdebt ♬ original sound – Brittney Reynolds

According to CBS News, over 60% of Americans live paycheck to paycheck. Another 45% say they couldn’t get their hands on $1,000 in an emergency without turning to a credit card. The automatic transfer, while darkly humorous, meant to facilitate savings, instead becomes a symbol of how systemic financial advice and tools often miss the mark for those for whom every cent truly does count.

In a world where financial stability is often a hidden struggle, perhaps the real takeaway from Reynolds’ viral moment is the importance of empathy, shared experiences, and the need for a reflection on a banking system that 50% of Americans don’t trust.

The Daily Dot has reached out to Reynolds about her experience via email and Wells Fargo via email about this policy.

Update Oct. 18, 4:24pm CT: In a follow-up video, Reynolds averted financial crisis by noting that she got paid. In said clip, which has amassed 500,000 views since being posted five days ago, she applies her paycheck toward her various credit card debt balances. She also flagged this very article in another follow-up video, noting that “a win’s a win.”