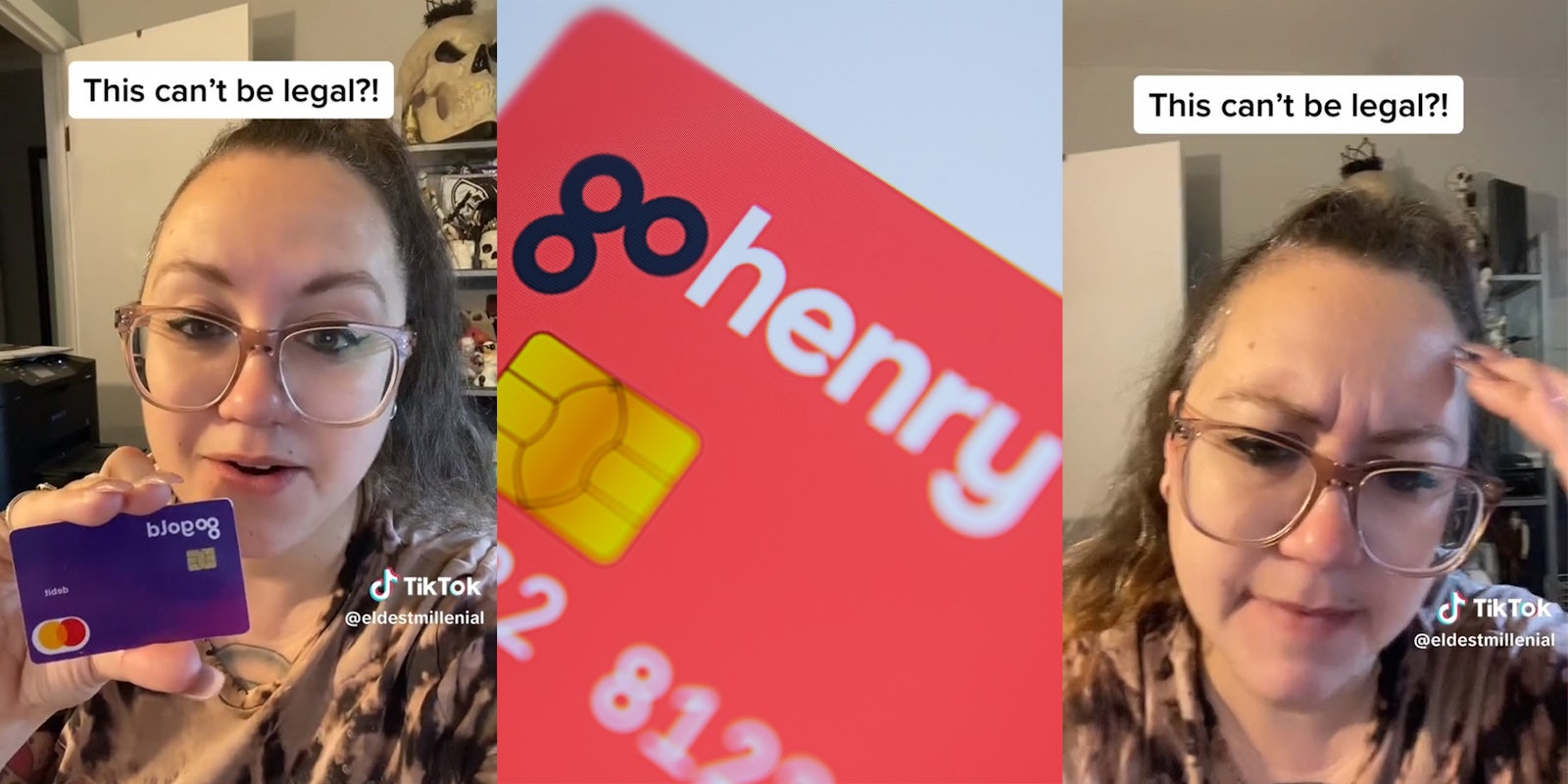

A mom who uses GoHenry claims the service put a negative balance on her kids’ debit cards and wants her to pay for their mistake.

GoHenry offers prepaid debit cards that parents can add money onto and give to their children. These cards allow people to regulate how much money their kids are spending. According to its website, “children can only ever spend the money available on their GoHenry card. There’s no risk of them getting into debt or overdraft.”

However, TikToker Jennifer (@eldestmillennial) posted a video in which she claims that her children’s cards had negative balances on them. Furthermore, she received emails from GoHenry saying that she needed to pay the negative balances off if she wanted to continue use the cards.

@eldestmillenial I have no idea what to do about this, but it feel class action lawsuity to me. #gohenrycard #customerservice ♬ original sound – Jennifer

Jennifer explains the situation in a series of videos. “Last week on May 11th, my son sent me a text message. He was out with some friends and he said hey we’re gonna get some fast food — can you please put $10 on my card.”

“Sure,” she told her son, “that’s what it’s for.”

But when Jennifer checked the balance on her son’s card, she was shocked to see it was in the red. The mom claims she had to pay $80 just for her son to be able to use his card again.

But, as Jennifer notes about the negative balance, “you can’t spend money that’s not already loaded onto this card so I was very very confused.” At this time she checked her daughter’s GoHenry card and sure enough, it also had a negative balance.

“So immediately I knew something was wrong.” Jennifer then decided to go online in search of answers. “I started at the internet and just saying like is Go Henry having issues right now, like, what’s going on with Go Henry? Nothing. Internet silence.”

The next day, the mom received an email from GoHenry. It said that they had experienced a “a third-party issue” that resulted in the negative balances on her kids’ cards. However, instead of offering to resolve the issue, GoHenry said that Jennifer would need to pay off the negative balances.

Jennifer didn’t make the same mistake twice. “What I don’t do is top of my daughter’s account I’ve already been forced to do this for my son’s account,” she said. She decided to simply wait for GoHenry to figure out a solution.

But in a follow up video the TikToker stated that GoHenry continued to refuse to acknowledge their error. Jennifer says they kept referring to it “a third party problem”.

@eldestmillenial Apparently its all a third party issue with these guys. No ownership of the issue, just “passing the buck” around and landing on the customer. #gohenry #customerservice ♬ original sound – Jennifer

They also informed Jennifer that she still had to pay $150 to continue using her daughter’s card. The TikToker was flabbergasted.

She said that she was expecting a “credit to [her] son’s account” and thought it was odd that the company wouldn’t at least offer to cover the money that she spent due to their error.

GoHenry’s own website touts its “no overdraft facility” and the company reinforces what this mom says in her videos — that going into a negative balance isn’t possible on these cards. According to their website, Jennifer’s kids shouldn’t have been able to spend money that she had not already pre-loaded to the card.

TiKTokers were shocked by the company’s response. They couldn’t believe that GoHenry expected Jennifer to pay for a mistake that wasn’t hers.

“Are they saying that $$ was erroneously added to the cards, and was spent, and the negative balance is because they just took that $$ back?” one person wrote.

“So they are expecting you to pay for their error… ugh,” read another comment.

Many suggested that Jennifer seek legal counsel and file a formal complaint immediately.

“Lawyer. Plus file a complaint with the Consumer Financial Protection Bureau. Stat,” said one user.

“It’s time to contact the CFPB and your states banking regulator,” wrote another.

The Daily Dot reached out to GoHenry via email and Jennifer via TikTok comment.