Credit card interest rates can be incredibly high. According to CNBC, “the average consumer paid a 22.8% interest rate on their credit card balance at the end of 2023, the highest since the Federal Reserve began tracking data in 1994.”

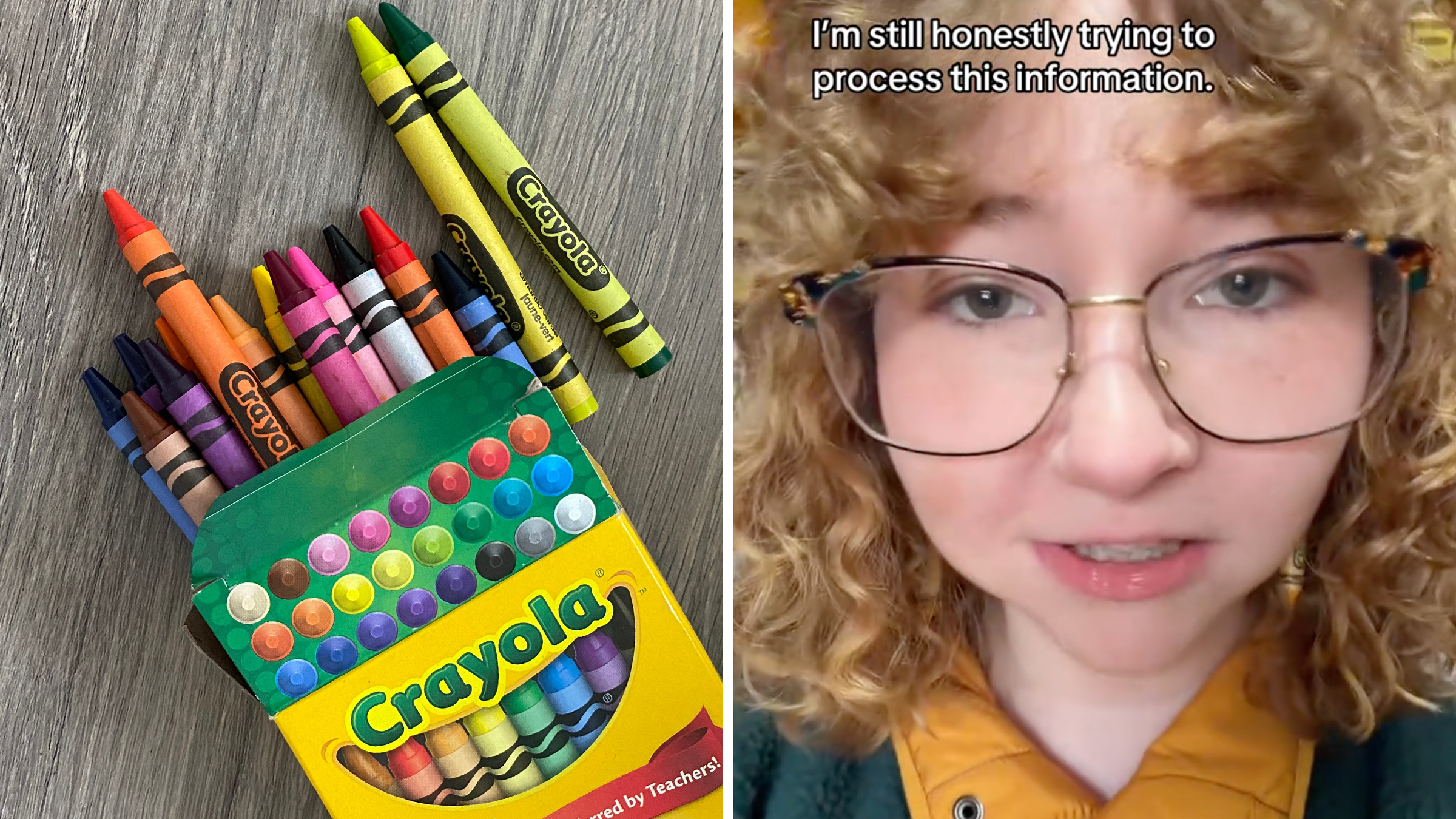

Although these rates are high, it’s generally easy to avoid spending money on them so long as one pays off the entirety of their statement balance by the due date. However, that is a task that may be easier said than done, according to TikTok user Jordan Nutter (@anutterhomeloan)

A credit card with daily interest

In a video with over 375,000 views, Nutter says that she paid off her credit card balance by her statement’s due date. It was surprising, then, to see that her bill included $55 in interest fees.

“I called them to figure out—this must be a mistake,” she explains. “And no, it wasn't a mistake.”

According to Nutter, her credit card agency, a company called Mercury, decided to start charging her interest on a daily basis.

“So if I charge something today and I don't pay it off today, they're going to charge me interest, even though I paid off before the…statement due date,” Nutter summarizes.

As a result of this change, she says she will be leaving the company.

“Mercury, in case you were watching this, you lost a valued customer, and I will be taking my business elsewhere,” Nutter concludes.

What are Mercury credit cards?

Mercury credit cards are distinct from Mercury, which bills itself as a financial technology company "founded with the idea of making banking better for startups."

According to NerdWallet, Mercury credit cards are beneficial for those who are building credit, as they do not have an annual fee and allow users to earn rewards from their purchases.

That said, the interest rate for Mercury cards is considerably higher than industry averages.

“As of this writing, cardholders will pay 29.99% to 30.24% variable APR if they get into credit card debt — well above the average of 22.77% among credit cards assessing interest as of August 2023, according to the Federal Reserve,” writes NerdWallet author Sara Rathner. That APR is now “29.99% to 32.99%,” per Mercury’s website.

Regarding Nutter’s claims about being charged interest daily, Mercury’s website offers several examples of the agreements they send card holders. In each one, the company promises, “We will not charge you any interest on Purchases if you pay your entire balance by the due date each month.”

That said, interest for cash advances and balance transfers begins immediately, so Nutter could be referring to that.

Finally, it does not fully fit Nutter’s description, but there is a possibility she could be referring to the idea of “residual interest” or “trailing interest,” which is not unique to Mercury cards.

As explained by Credit Karma, “Some credit card issuers calculate interest on a daily basis, not just when your statement is generated — which means that you can accumulate interest on your account after the statement date but before the credit card company receives your payment.”

@anutterhomeloan Mercury, you loat a long time client today. #anutterhomeloan #realestate #mortgage #firsttimehomebuyer

♬ original sound - Jordan Nutter | NFM Lending

Commenters say it's not worth it

No matter what changed about Nutter’s credit card, commenters say that, given just how many credit cards there are out there, keeping one with which you’re not satisfied simply isn’t worth it.

“There's too many cards out there to tolerate a bad one,” wrote a user.

“Yesssss I just had a credit card company do that!!! I didn’t even know I owed because I paid it off and didn’t use it,” claimed another.

“It hurts your credit to cancel a card. Just get the balance to zero and put it in a drawer,” suggested a third.

The Daily Dot reached out to Mercury Financial via website contact form and Nutter via email and TikTok comment.

Update 8:20am CT, Jul. 4, 2024:

In an email to the Daily Dot, Nutter clarified her situation.

“Mercury now charges daily interest, similar to an installment loan as opposed to charging interest based on the statement balance you carry,” she claimed. “My last statement showed that I paid it off by the due date in full, yet still had a $55 charge for interest. I gave them a call to clear up the issue and they informed me that they now charge interest on a daily basis so if I make a purchase today and don't pay it off then I will be charge interest on it until the amount is paid. I made no cash advances or balance transfers. The charges on my card for the month were solely from expenses made directly onto the credit card.”

“The whole purpose of credit cards in my opinion is having access to a line of credit that protects you more than using a traditional debit card,” she continued. “I have always worked off, ‘if you pay your statement balance off then you won't accrue any interest.’ Since that is no longer the case with Mercury, I have redeemed all of my outstanding points and have been researching different companies I can move my business over to.”

The internet is chaotic—but we’ll break it down for you in one daily email. Sign up for the Daily Dot’s web_crawlr newsletter here to get the best (and worst) of the internet straight into your inbox.