In recent years, the price of car insurance has gone up substantially. On average, car insurance premiums have increased by 17% over the past year, according to the Washington Post. In some states, that number is even higher. Colorado saw a year-over-year increase of 53%, while Florida’s premiums went up by an incredible 88% in the past year.

The reasons for these increases are varied, experts say.

“Car repair costs, body shop wages, and used car prices have all had significant increases,” Frank Palmer, chief insurance officer at Root Insurance, told the Washington Post. “The entire industry has had to raise rates to keep up with these trends.”

This has left many drivers in an awkward position, as having car insurance is required in most states, and a car itself is necessary for many to get to work.

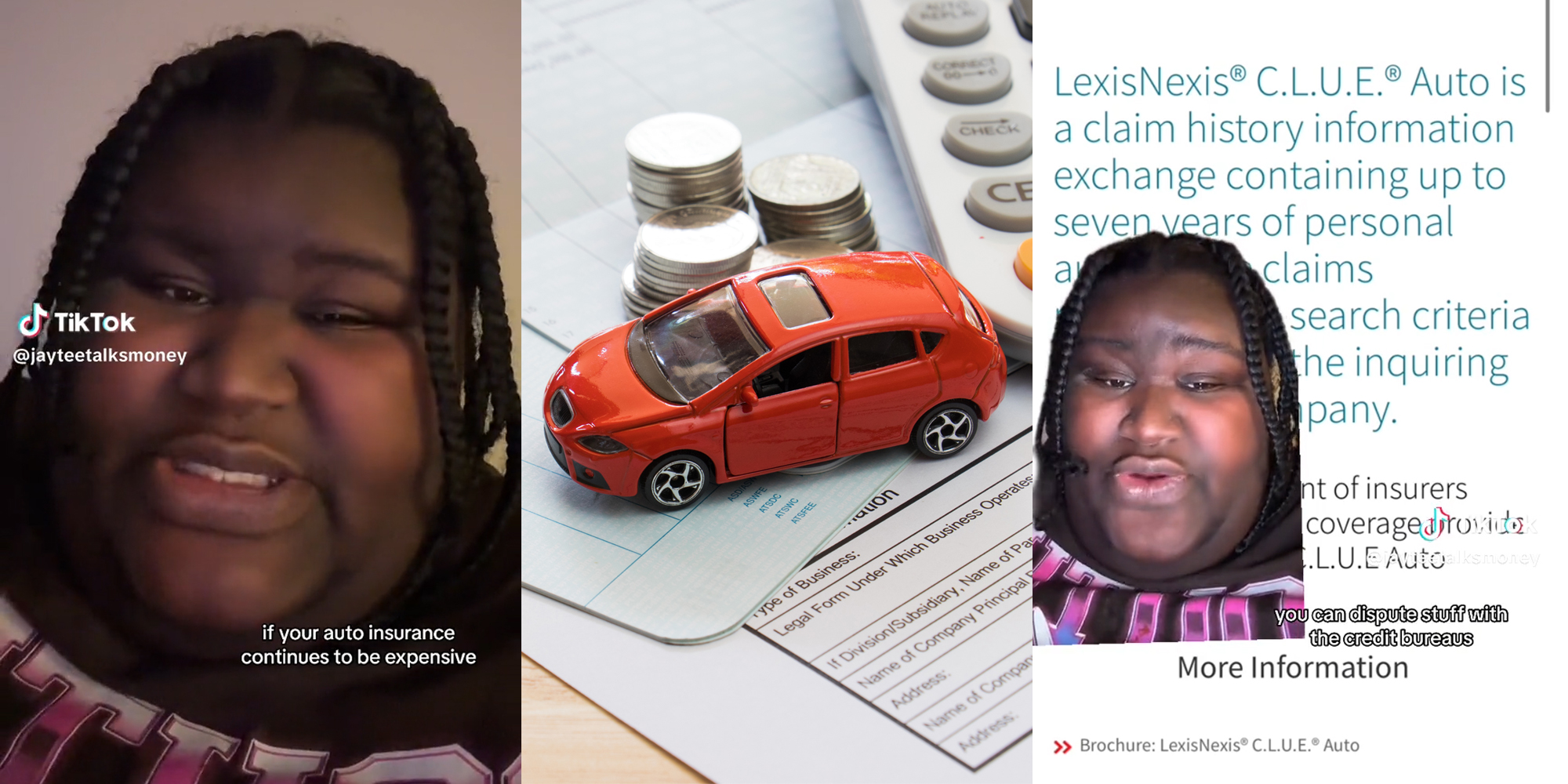

If one is wondering how to reduce their rates, TikTok user JayTee (@jayteetalksmoney) has answers.

In a video with over 718,000 views, JayTee says that insurers frequently use a LexisNexis C.L.U.E. report to calculate your premiums. However, this isn’t always an accurate reflection of you as a driver.

“You need to pull that report,” JayTee says. “The reason you pull that report is because when I pulled mine…there were vehicles and accidents and incidents and tickets that I had never been associated with. And you can dispute [them] yourself, the same [way] you can dispute stuff with the credit bureaus.”

In the comments section, many users spoke to the veracity of this tip.

“Yep.. I sell insurance for a major insurance company and this is the exact report we pull,” wrote a user.

“I worked for them for 6 years in different data collection divisions. Dispute. Dispute. Dispute and the dispute again,” added another.

“This is so true! I’m an insurance agent and we see so many accidents that shouldn’t be associated with those people on the report,” stated a third.

"I discovered LexisNexis during my career as a credit coach," JayTee told the Daily Dot via email. "LexisNexis actually plays a huge part in credit reporting, so while digging deeper, I discovered the C.L.U.E. AUTO report that is included in a consumers LexisNexis file."

JayTee later posted another video showing how users can dispute fraudulent listings on their accounts.

@jayteetalksmoney #stitch with @JayTee Credit Coach ? #greenscreen #lexisnexis #clueautoreport #carinsurance #jayteetalksmoney

♬ original sound - Jaytee

"I have had people come back and say their auto insurance premiums decreased as much as $100-$150 per month just by clearing inaccurate information inside of their LexisNexis report/CLUE Auto Report, so it's definitely something I recommend everyone look into," JayTee explained. "Personally, I think these reports can be so inaccurate because LexisNexis' business is aggregating consumer data so I feel like their goal is focusing on compilation versus accuracy. When they gain all this information from various sources, they don't take the time to ensure its accuracy."

Back on TikTok, others shared further tips to lower car insurance costs.

“I opted out of all 3rd party reporting. my insurance is now 195 coming from Gieco at 536,” revealed a commenter. “You can Google opt out for all of the 3rd parties Lexus Nexus,Sage and corelogic. filled out the form and wait 30 days. You get a letter to confirm.”

“I pay $80 a month full coverage!!! I got my policy thru Costco with Midvale if anyone is shopping around with a Costco membership,” offered a second.

Still, many simply lamented the rising cost of car insurance.

“Mine keeps going UP! No tickets, no wrecks, NOTHING,” declared a commenter.

“Yeah auto insurance should not be more than my car payment,” stated an additional TikToker.

“Mine jumped from 127 a month to 187… nothing changed on my end and I don’t get why it was raised so much,” detailed a further user.

In closing, JayTee told the Daily Dot that inaccuracies like the ones he noted in the video don't just happen on C.L.U.E. Reports.

"PLEASE pull your reports outside of your typical 3 credit reports," he advised. "Secondary reporting agencies such as Lexis Nexis among others gather so much information and sell it to so many companies for so many reasons that those reports can be more influential in decision making than your actual credit report, especially if you have less than perfect credit. Typically these reports will 'fill in the blanks' on what type of consumer you are — and if there is inaccurate information, that ultimately harms you."

The Daily Dot reached out to LexisNexis via email.

Update 11:18am CT September 7: In an email to the Daily Dot, LexisNexis provided additional information about its C.L.U.E. reports.

"LexisNexis Risk Solutions provides information to insurance companies and their agents to help them determine if applicants meet the insurance companies’ underwriting guidelines and to determine available coverages and the premium to be charged for homeowners and automobile insurance. LexisNexis Risk Solutions maintains a database of insurance claims filed by nearly all insurance companies. This database is called C.L.U.E.®, which is an acronym for Comprehensive Loss Underwriting Exchange," the email reads.

"If your insurance company has sent you an adverse action letter, please contact the LexisNexis Consumer Center at 1-800-456-6004 to request the information related to the adverse action," the message continues. "Please be ready to provide your first and last name, Social Security Number, driver’s license number and state in which it was issued, date of birth, current home address and phone number. If your insurance carrier provided a reference number on the adverse action letter you received, please be ready to provide it, as well."

More information about this can be found here.