In a viral TikTok posted by @oops, a finance app designed to help users not waste money, a woman claims she drunkenly applied and qualified for a $200,000 loan from Chase Bank, despite only having $750 in her account.

@oops ummm customer support? #greenscreen #creditcard #debtconsolidation #debtfreejourney #nycvlogger #nyclifestyle ♬ UH OHHH – Killa

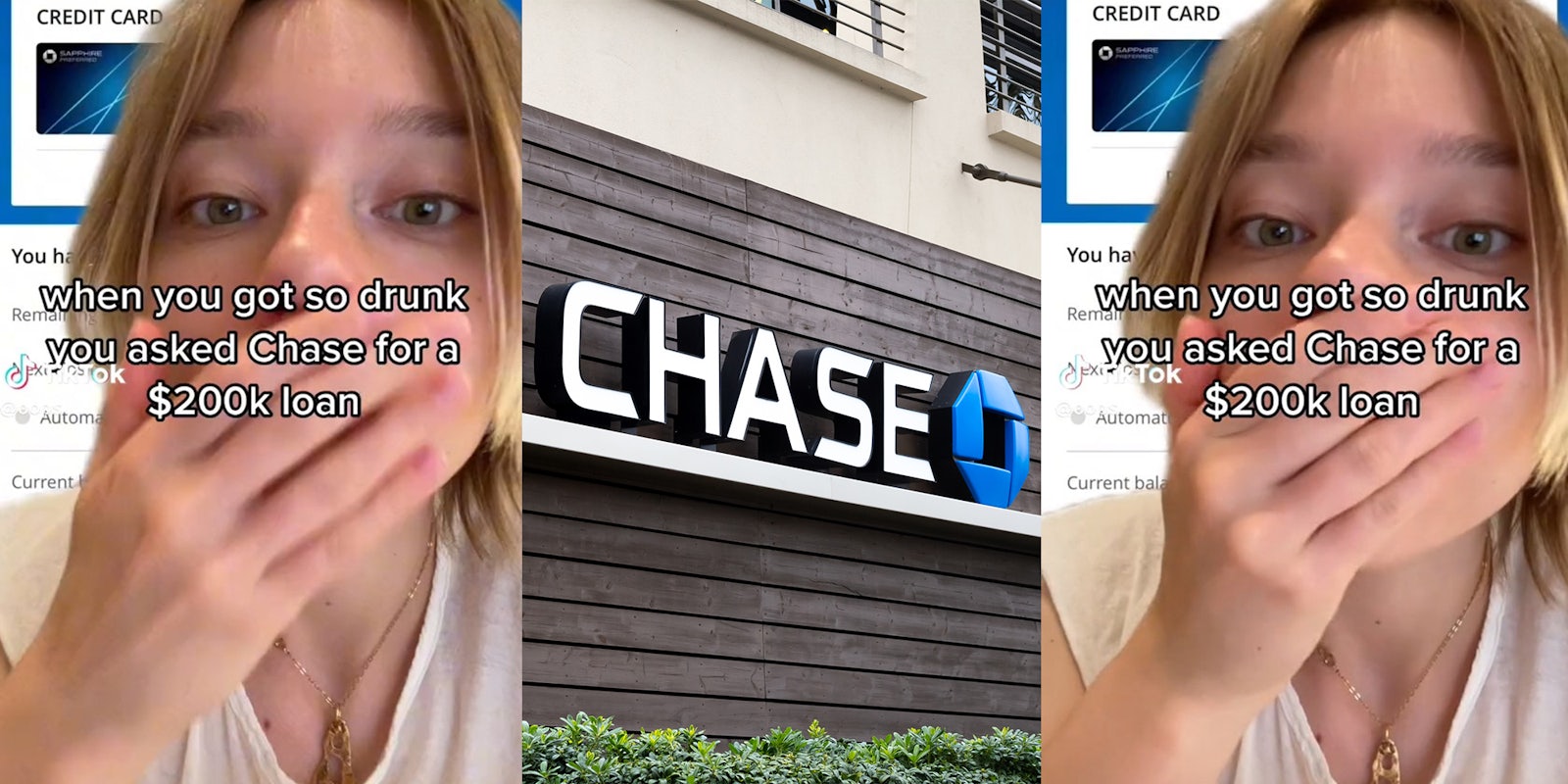

The woman in the video appears with her hand over her mouth in front of a greenscreen. “When you get so drunk you asked Chase for a $200k loan,” she writes in the text overlay of the five-second clip. She then proceeds to show the screenshot behind her that displays a usable balance of $200,750.68 on her credit card.

Many posts on the @oops account appear to be part of an online guerrilla marketing campaign that feature made-up financial situations. The brand’s strategy on TikTok seems to be working as the recent clip has amassed 1.2 million views.

Many TikTokers expressed shock that Chase Bank approved her for such a large loan. “How do you get approved that fast?” one person asked.

Another joked, “Sis let me borrow $10k.”

A third pointed out that it seemed imprudent for Chase Bank to have approved the loan in the first place.

“The fact that you had 750 in the bank and they still gave you 200k.”

Unfortunately predatory lending in all too common and it can leave victims with unmanageable debt and ruined credit. Broadly defined as unfair tactics used by lenders to dupe customers into taking out loans they can’t afford, the Federal Deposit Insurance Corporation (FDIC) offers a number of resources to address this problem.

Others remarked that she could use the loan to immediately pay back what she borrowed from Chase Bank.

“You still got the 200k just pay it back for free credit,” one comment read.

Another warned that the woman should “Take the check and pay the loan back immediately before any interest is charged.”

One user also helpfully suggested she speak to Chase Bank about the erroneous loan. “Could honestly prob call back and say I was intoxicated and did this, and they would redo this action.”

The Daily Dot has reached out to JP Morgan Chase via email and Oops via Instagram DM for further information.