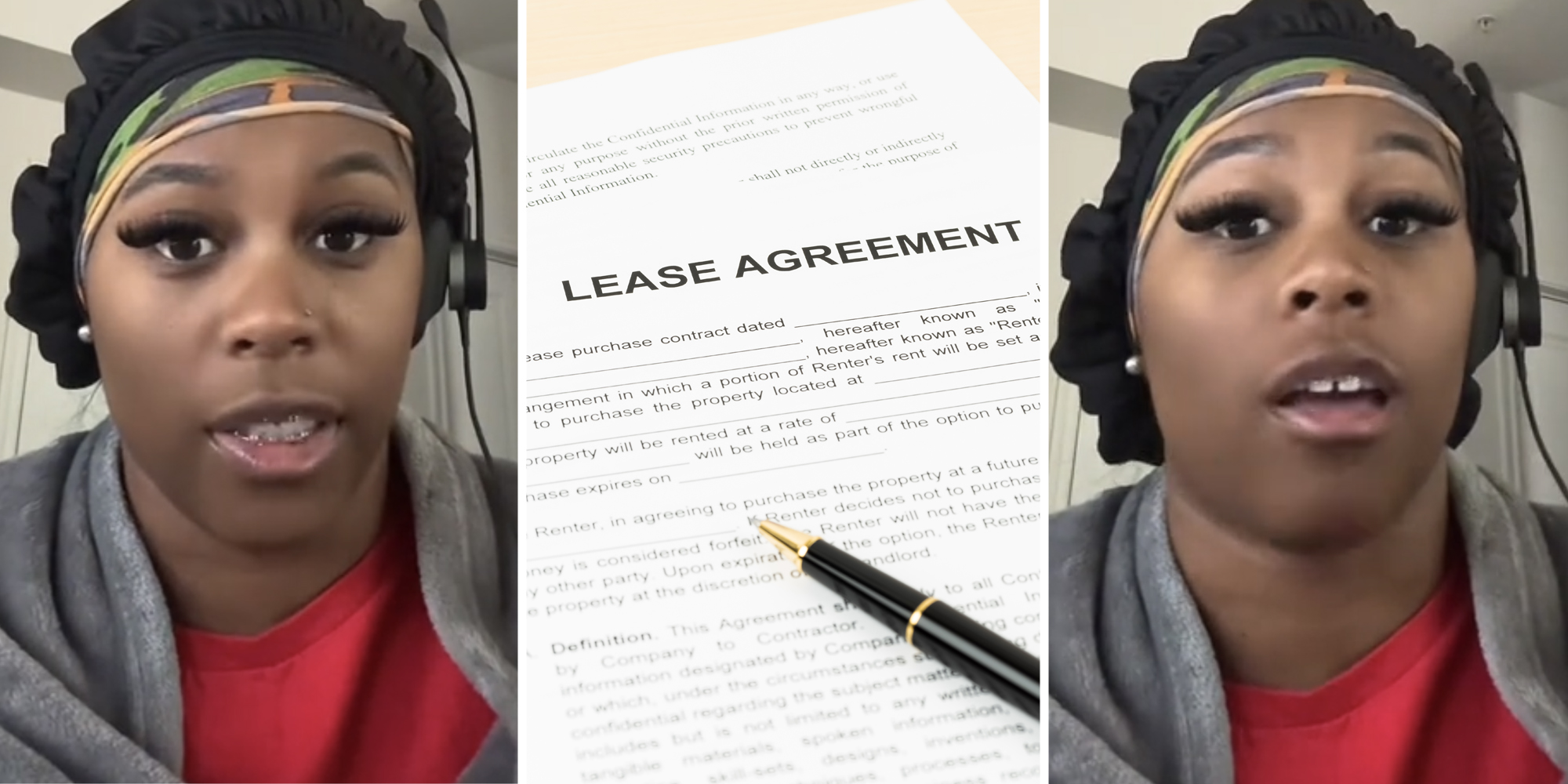

Leasing a car can become very expensive very fast. One TikToker learned that the hard way after failing to read the fine print when leasing a 2020 Audi A4.

TikToker Deshae Raven (@deshae_raven) detailed her leasing experience in a video with over 30,000 views.

Raven says the first big problem she had with her lease—something she only discovered after the fact—was that the sales representative didn't make her aware of the mileage limits on the vehicle, as well as the price per mile if she were to go over.

About two-and-a-half years into leasing her Audi, Raven says she was browsing TikTok and saw a post from a person who leased a BMW. They posted that they have to fork over a ton of money in mile overages. This got the proverbial coals burning in Raven's head.

And so she says that she decided to look at her own contract to find out just how much money she'd have to pay, if any, for going over the allotted miles she initially signed up for.

This was on top of the $934 a month she was paying to lease the car, not including insurance.

Then, the financial hammer dropped.

"I think I owed like $1,200 on the car," she says of the balance at the end of her lease. "When the man came out to inspect the car, there were no damages. Interior was good. But what messed me up, y'all, was the mileage. I had to keep the mileage under 11,000 per year. So within four years, there was probably what 44,000-45,000 miles if I'm doing the math correctly."

Unfortunately, she went way over the mileage limits. "Y'all. I had still owed Audi financial an additional $6,700 because of the mileage overage that I went over on that car," she says.

She goes on to issue a warning to Uber and Lyft drivers. She urges them to stay away from leasing a vehicle at all costs, as the miles can quickly add up.

"That right there pissed me off," she says of the experience. "I would never in my life lease another car. ... How the hell I go from owing ... Audi $1,200 as my last payment and then owing them an additional $6,000. That don't make [expletive] sense, but you know what? I fault the finance manager. Finance manager did not tell me the ins and outs of this damn vehicle. They just wanted a damn sale," she says.

Why reading the contract is so important

Commenters who heard her story had a variety of reactions. Some viewers were stuck on her initial monthly payment on the vehicle. "I got lost at $934. No thank u lol. Ima keep my ford," one said.

Another "hidden" fee can include any cosmetic damage the vehicle may have sustained in one's years of leasing it. Some dealers might waive if you decide to "re-up" and get another car with them.

However, all of these stipulations should be included in the leasing agreement/contract. So before you sign on the dotted line, it's imperative you read and understand everything in the contract, especially when it comes to your responsibilities as the driver/temporary car owner.

"READing is fundamental especially when signing contracts," one viewer said.

Another replied that this appears to be a recurring trend among those who lease their vehicles. "I knew this was a mileage story when you said lease," they wrote.

You can make money back on your lease

Leasing is not a bad option for everyone, however. "I’m in my 2nd yr of my lease and haven’t met my 12k miles per yr for 36 months. I’m at 8k miles rn. They gon owe me money in the end," one said.

There are some who state that drivers could try and leverage this point in order to put some extra cash in their pocket.

The Daily Dot has reached out to Raven via email for further comment.

The internet is chaotic—but we’ll break it down for you in one daily email. Sign up for the Daily Dot’s web_crawlr newsletter here to get the best (and worst) of the internet straight into your inbox.