A content creator said she recently learned a trick from “the rich” when getting a new car: Leasing versus buying. But, as commenters noted, this so-called hack probably only works if you’re, well, rich.

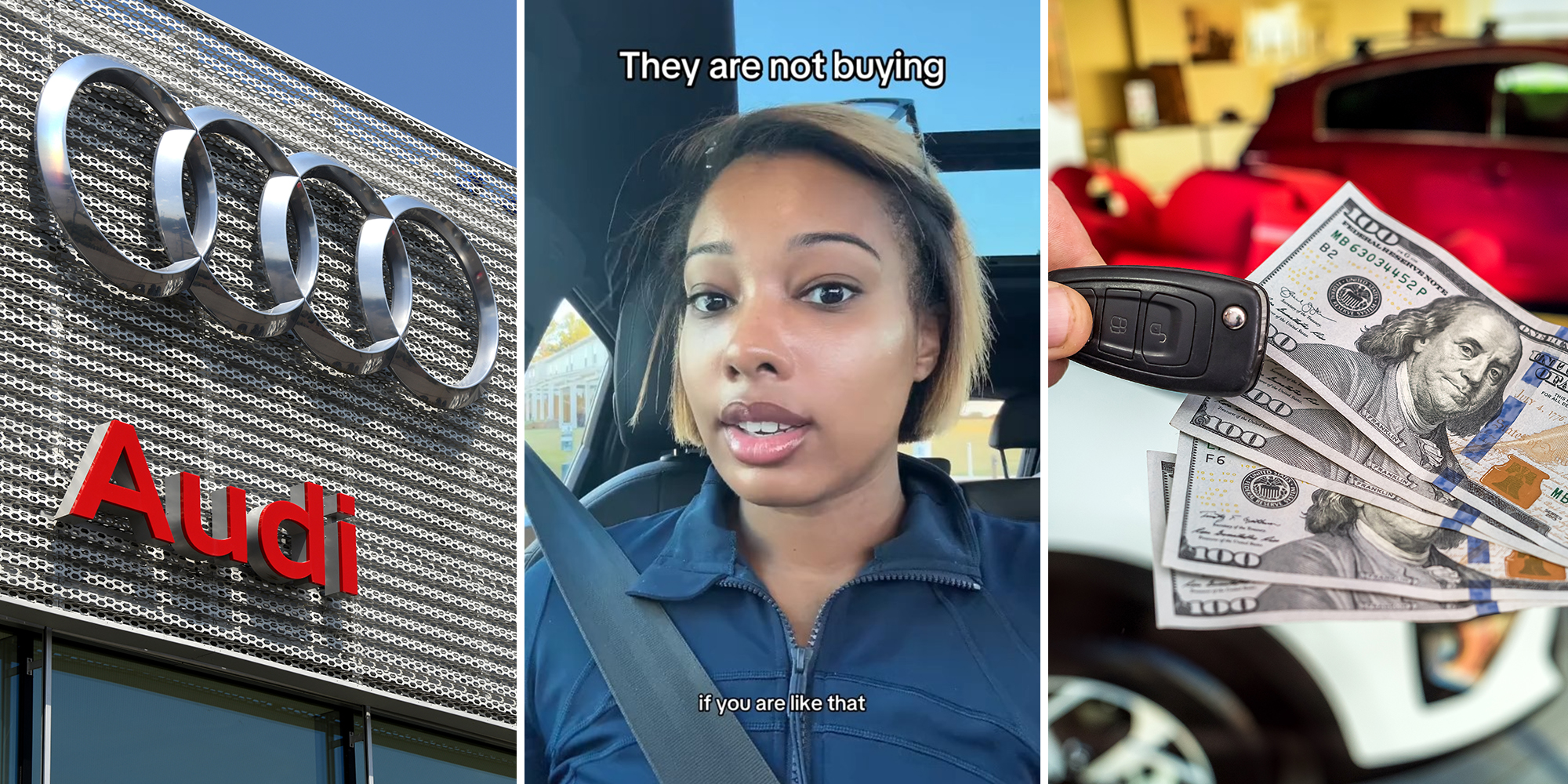

TikTok user @dimedocs recorded the video from her 2020 Audi Q3, which she said she paid off recently. Moving forward, however, the content creator said she planned on leasing cars.

Essentially, she feels like this will work for her, as she said she likes to get a new car every few years. But is leasing really smarter than buying?

Leasing versus buying a new car

Of course, there are pros and cons to both. According to Consumer Reports, some of the benefits of leasing include lower monthly payments, benefits included in the lease (which can include free oil changes and other scheduled maintenance appointments), and not worrying about the car’s trade-in value or the hassle of selling it if you end up wanting something new.

On its face, leasing a car appears attractive. But there are a number of downsides to doing so, according to Consumer Reports. For one, if you continually lease, then you’re essentially in a never-ending cycle of monthly payments. It also noted that lease contracts specify a limited number of miles. “If you go over that limit,” the article stated, “you’ll have to pay an excess mileage penalty.”

Meanwhile, with buying a car, drivers will have total control over their vehicle. That means you pay for service and repairs on your own, but the upside is you get to decide what to do when you no longer want the car. Give it to a family member? Exchange it for a new car? Sell it outright? The choice is yours.

But as @dimedocs noted, too, one downside of buying a car is that a car’s value depreciates over time. Driving is also expensive: According to a 2024 study by AAA, the cost to own and operate a new car is $12,297.

What did ‘the rich’ tell @dimedocs?

@dimedocs said that her rich friends advised her to lease—something they, too, are apparently doing.

“Y’all know what the rich told me? And you may not believe this, but they are not buying cars,” she said. “They are leasing them.”

Initially, @dimedocs said she believed that buying a car—and owning the title—was the way to go. “Turns out that’s not true,” she said. “My next car, I’m going to just lease.” She said that this system works for her, in particular, because she likes to “stay in a new car.”

“That’s why I try to pay it down, so I can enjoy the perks of not having a car note, but still having a decent car,” @dimedocs said. She also said that leasing a car is akin to “glorified renting.”

“I heard that they cover all the maintenance with your [expletive] so you’re not even liable,” the content creator explained. “I see why the rich say lease your cars… because they’re really just toys.”

As of Sunday afternoon, her clip had amassed more than 1.7 million views.

Commenters aren’t buying the advice

A few commenters noted that while @dimedocs’s advice might sound good, rich people are more likely to reap the benefits of leasing versus purchasing a car.

“Rich people lease cars because they can afford to pay leases ongoing,” one woman said. “Regular people should buy a good car and take care of it, then drive it till the wheels fall off.”

“Rich people are leasing cars because they can afford it,” another wrote. “Average people leasing cars for the sake of having a new car all the time will forever be paying for a car.”

“This isn’t financial advice, this is luxury advice. If you want to save money you can buy a used Toyota that you can pay in CASH and will last you well over 10 years,” a third commenter added.

As a result, many viewers said they were fans of buying cars—especially from reliable brands.

“You buy a Toyota/Honda… and lease the luxury car,” one woman advised.

“I own a 2006 Toyota Camry. It's been paid off since 2009. I haven’t had a car payment in 15 years,” another viewer shared. “Some people prefer having payments. EVERYONE’S DIFFERENT.”

“I paid off my car earlier this year & I'ma enjoy not having a car note for as long as I can,” a third person said.

@dimedocsreal Own one but lease the next

♬ LET HER COOK - GloRilla

The Daily Dot reached out to @dimedocs via TikTok comment.

Internet culture is chaotic—but we’ll break it down for you in one daily email. Sign up for the Daily Dot’s web_crawlr newsletter. You’ll get the best (and worst) of the internet straight into your inbox.