The Senate is expected to vote on the Republican-led tax bill as early as Tuesday, but as the vote nears, a fight erupted online about the criticism surrounding the deal.

The tax bill, called the “Tax Cuts and Jobs Act,” is being debated by the House of Representatives and is expected to pass early in the afternoon. Following the House vote, the Senate will begin the same process, and a final vote on the bill could come on Tuesday evening.

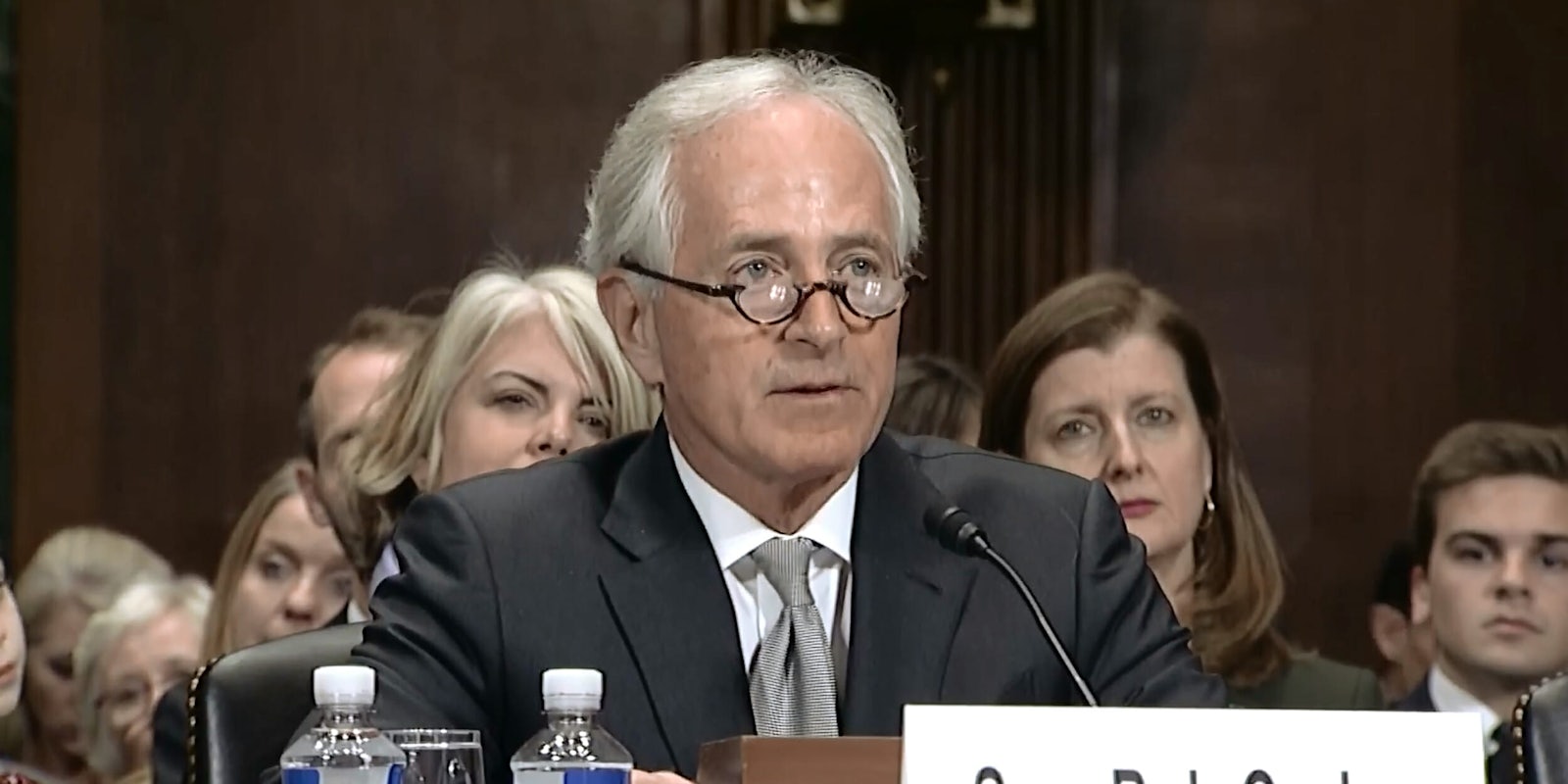

Some of the criticism of the tax bill has come from Sen. Bob Corker (R-Tenn.) who flipped from voting no to publicly saying he would vote yes.

“It’s been really tough, especially because I did think, I really felt like we could have had a bipartisan bill that would have really withstood more fully the test of time,” Corker said, according to the New York Times.

A debate has raged over Corker’s flip to yes and if it has anything to do with a late addition to the tax bill that would benefit people with real estate holdings, like Corker. The provision has come to be known as the “Corker Kickback” online.

The International Business Times reports that more than a quarter of Republican senators voting on the tax bill will get a tax cut through real estate shell companies. The provision was not in the version of the bill that was voted on in early December.

The “#CorkerKickback” quickly spread online as an outlet for outrage over the tax bill.

The #CorkerKickback is just another example of how the #GOPTaxScam is a Frankenstein’s monster of giveaways to special interests – and a reminder of why @SpeakerRyan & @SenateMajLdr are trying so hard to pass this bill before the public learns even more. https://t.co/I7hXWMbc15

— Nancy Pelosi (@SpeakerPelosi) December 18, 2017

Sherlock: Why did @SenBobCorker flip his tax vote?

— Ted Lieu (@tedlieu) December 18, 2017

Watson: Because new bill addresses his deficit concerns.

Sherlock: It doesn’t.

Watson: Because he read the bill?

Sherlock: Nope. But have you looked at #CorkerKickBack?

Watson: Wow

Sherlock: It’s elementary, my dear Watson https://t.co/BI784yFMLV

Sen. John Cornyn (R-Tx.) seemed to take umbrage with the idea that the provision was added to benefit certain senators.

“The real lesson of the kick at Bob Corker is how terrified the left is of a bill that could be a popular tax cut that helps the economy and lifts incomes,” Cornyn tweeted, quoting a Wall Street Journal editorial.

Cornyn continued in a series of tweets:

“Under #TaxCutsandJobsAct the typical family of four earning the median family income of $73,000 will receive a tax cut of $2,058, a reduction of nearly 58 percent. Under #TaxCutsandJobsAct a single parent with one child and an annual income of $41,000 will receive a tax cut of $1,304.50, a reduction of nearly 73 percent. Under #TaxCutsandJobsAct a married couple earning $100,000 per year ($60,000 from wages, $25,000 from their non-corporate business, and $15,000 in business income) will receive a tax cut of $2,603.50, a reduction of nearly 24 percent.”

Corker also responded to the #CorkerKickback chatter.

Earlier today, Chairman Hatch responded to my letter about reporting over the weekend about my involvement in the tax reform legislation, calling the accusations “categorically false.” “I am disgusted by [the] press reports,” he wrote. https://t.co/IfAr9sBmNQ

— Senator Bob Corker (@SenBobCorker) December 19, 2017

He also shared the Wall Street Journal article defending his decision to support the tax bill, a tweet which got thoroughly ratioed.

Deficit Hawk my ass #CorkerKickback pic.twitter.com/ZDp8FQxaS6

— ElElegante101 (@skolanach) December 19, 2017

resign.

— Eric Hassan (@EricHassanXXX) December 19, 2017

The real reason we’re angry with you is because you’ve compromised your declared values yet again, and we know who will get the lion’s share of benefits in this sham. You’ve sold us out, and you’ve proven that you lack integrity. You deserve MOUNTAINS of scorn for that.

— Laura – #StandsWithUkraine (@Beulahmo) December 19, 2017

With Corker’s support, the bill is expected to pass and head to President Donald Trump‘s desk.