A user on TikTok has sparked discussion after accusing his bank of withholding charges and deposits to maximize fees.

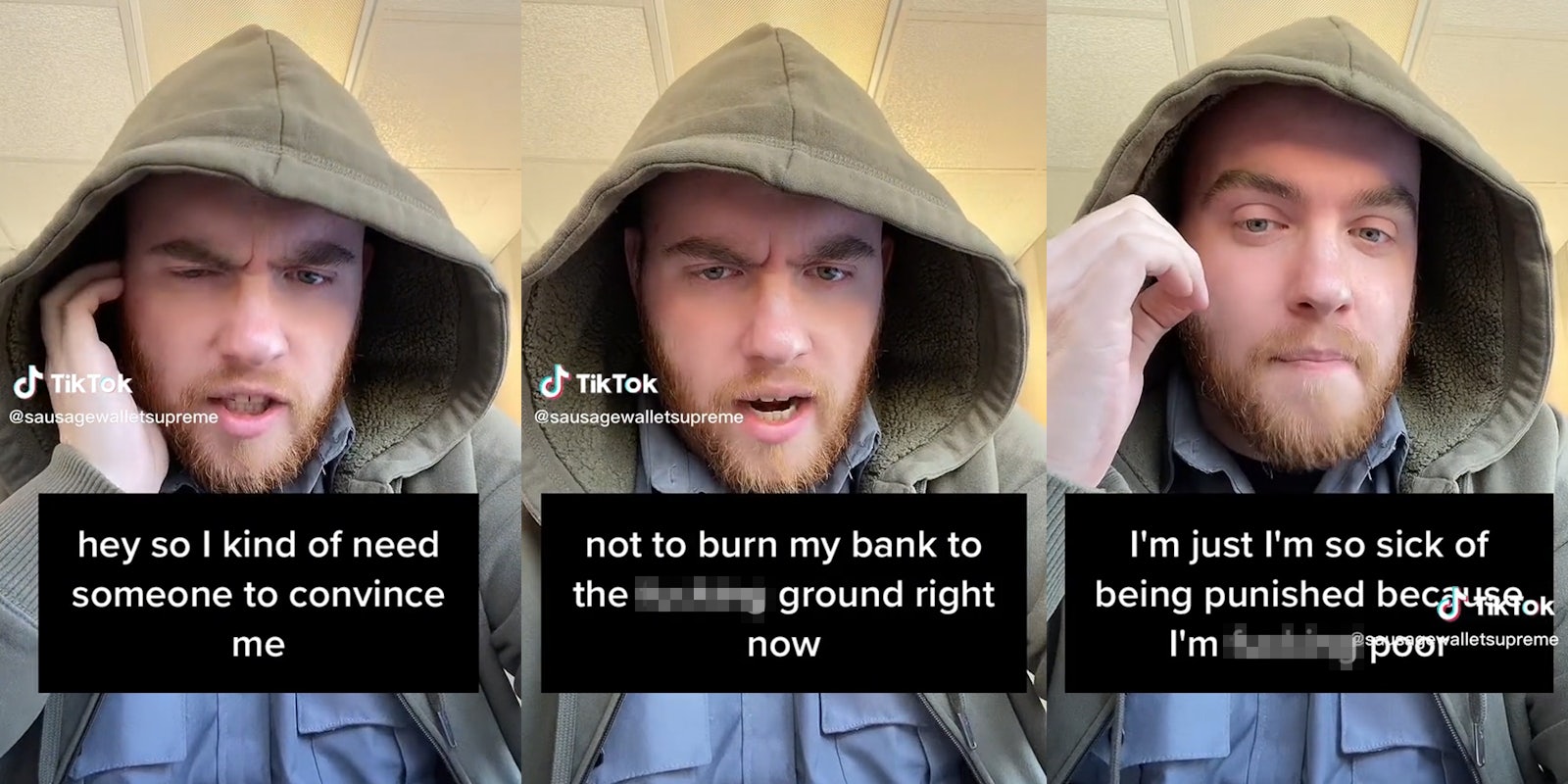

In a video with over 218,000 views as of Friday, TikTok user @sausagewalletsupreme angrily recounts his experience dealing with the American banking system and its overdraft protection charges.

“I kind of need someone to convince me not to burn my bank to the fucking ground right now,” he says at the video’s onset.

To summarize, @sausagewalletsupreme says that he incurred several unexpected bills in a single month, meaning that after he paid his rent and car payments for the following month, he was “good and cleaned out.”

“By Saturday, I had maybe $3 or $4 left in my account,” he recalls.

However, he says this is when something strange happened. A while before this series of events (@sausagewalletsupreme claims it was “months ago”), the TikToker accidentally overdrew his account. This meant he incurred a penalty — a penalty many banks dub “overdraft protection.”

Rather than being charged for the overdraft then and there, the TikToker says the charge was put on credit at the time so the money would be taken out later. It was indeed charged later, at this same moment when his account was nearing its lowest.

This meant that rather than $3 or $4 in the account, the TikToker suddenly had a balance of approximately -$30.

To resolve this, @sausagewalletsupreme says he contacted his roommate, who lent him around $40 via Venmo under the agreement that he would repay her when he got paid the following Tuesday.

But @sausagewalletsupreme’s troubles were not over yet. While the account appeared to have been replenished, the TikToker says this wasn’t actually the case.

According to @sausagewalletsupreme, his bank has a policy that the overdraft fees will not kick in if the account is replenished within 24 hours. However, he alleges that his bank did not actually process his instant Venmo deposit into his account within those 24 hours despite appearing as though they had — meaning he incurred another overdraft fee.

Given an average overdraft fee charge of $35, this means that the TikToker was charged a total of around $70 for, in part, not having enough money in his bank account.

“Like, I know that banks are predatory and they do this kind of shit all the time, but fuck,” he states. “I’m just…I’m so sick of being punished because I’m fucking poor.”

He has since claimed that the bank tried to charge him several more overdraft fees for the same transaction.

In this video, he also notes that his bank, Citizens Bank, has started giving him refunds after claiming that a glitch caused them to double-charge customers. The TikToker now claims to be in a better financial situation thanks in part to donations from viewers, which he says he intends to repay.

Additionally, the bank allegedly told him that they would refund these overdraft fees. However, he tells Daily Dot via TikTok direct message that “I’ve been combing through my bank account and I’ve yet to see them get refunded. The only refunds I’ve received were for the double charges I mentioned.”

“I go through highs and lows with my finances like most working-class people,” he continued. “Some months I do alright and I’m able to treat myself or put some of it back into my savings. Other months I have tons of unexpected expenses that clean me out and leave me very close to the edge financially. This kind of thing NEVER happens when I’m doing good. They only rearrange my transactions when it could put me under, and [I don’t know] how any bank is still in business after doing that…Eat the rich lol.”

He further stated that the current issues have stopped since receiving his direct deposit and that he plans to move his funds to a credit union when available.

“Honestly, I have no idea what I could possibly do other than not give them my business anymore,” he says of a possible retaliation.

While banks are legally required to have customers opt-in to overdraft protection, many advertise the service as a benefit for the customer. However, banks actually make a substantial amount of money by doling out overdraft fees.

In 2019, the Consumer Financial Protection Bureau reported that banks earned an estimated $15.47 billion from overdraft and non-sufficient funds (NSF) revenue alone.

Furthermore, banks have been repeatedly accused of, and sued for, abusing or maliciously utilizing their overdraft protection systems.

“Wells Fargo picks and chooses when they are going to charge overdraft fees and when they are going to pay a bill or not,” reads a complaint filed on September 1, 2021, per Vox. “I will go to sleep and my account [is] positive and there is enough to cover pending charges. Then all of sudden days later the date of the [charge] is changed and I have been charged an overdraft fee. They have recently even had notices within the app that says your balance amount may not be accurate.”

In fact, in 2016, Pew Research reported that more than 40% of banks rearrange bank payments, usually ordering the payments from the largest dollar amounts to the lowest dollar amounts. This increases the likelihood that a customer will be charged multiple overdraft fees.

As far as lawsuits go, they are plentiful. In December 2022, Wells Fargo agreed to pay a $3.7 billion settlement with the CFPB stemming from issues related to, in part, the implementation of its overdraft protection policies. Earlier that year, Bank of America settled a case in which customers claimed they were being charged multiple overdraft fees for single transactions. In November 2021, TD Bank reached a settlement of $4.25 million for a similar issue.

These lawsuits are so common that almost every one of the top 10 commercial American banks has faced at least one such lawsuit since 2012: Chase Bank, Bank of America, Wells Fargo, CitiBank, U.S. Bank, PNC Bank, Truist Bank (formed as a merger between BB&T and SunTrust Banks), TD Bank, and Capital One. The exception is Goldman Sachs, which has had a rocky journey entering the world of commercial banking.

Whether the TikToker’s issue happened as a result of an error on Venmo’s part, another issue, or a malicious action by the bank is unclear. For its part, Venmo claims its instant transfers are processed on weekends as well as weekdays, and the money did purportedly show up in the TikToker’s account at the time.

All this said, many banks have already rolled back overdraft fees in certain cases, and the Biden administration has claimed they intend to crack down on overdraft and other “junk fees” (several industry trade groups have already made statements criticizing the administration for lumping overdraft fees in with other junk fees).

On TikTok, users were upset by how the events played out.

“Yes being poor today is even a bigger struggle than ever before! This capitalistic system doesn’t care! Food is now a luxury!” exclaimed a user.

“This is why I switched to a credit union,” shared a second. “I had a lot of issues with rearranging transaction before I switched.”

“It’s been happening frequently with us too. lol then they just shrug when you can’t dig yourself out over $30,” said a third.

Update 11:53am CT, Mar. 11, 2023: In an email to the Daily Dot, a Citizens Bank spokesperson shared the following: “On February 22, Citizens experienced a technical issue that showed duplicate transactions in some customer accounts. The issue was resolved within 24 hours, and any fees customers incurred because of this incident were rebated. We apologize for any inconvenience this caused.”