It’s that time of the year again. Nope, not summer (although that’s almost upon us), but tax season. I’ve never met someone who actually likes doing their taxes. But, thanks to TurboTax, I’ve met a few people who don’t absolutely dread it. If it’s your first time filing taxes like it was ours, here’s a guide to filing with TurboTax. We promise it won’t be too bad.

Read on to find out everything you need to know about this service, including a TurboTax review from me, a first-time tax filer.

What is TurboTax?

TurboTax is your one-stop-shop for getting your taxes filed this season. Ditch the in-person visits and pricey accountants, and fill out your TurboTax form from wherever you are—on any computer or mobile phone with internet access. You won’t have to download a huge program on your computer or worry about losing your information since TurboTax has no software to install and stores all of its info on its secure servers.

Is the TurboTax Free Edition really free?

Well, back in March of 2022, the FTC filed an injunction against TurboTax’s parent company. Why? They claim that TurboTax has been falsely advertising free tax filings. “In truth, TurboTax is only free for some users, based on the tax forms they need. For many others, Intuit tells them, after they have invested time and effort gathering and inputting into TurboTax their sensitive personal and financial information to prepare their tax returns, that they cannot continue for free; they will need to upgrade to a paid TurboTax service”

If you’re hoping to file your taxes for free, make sure you’re following the fine print. Those filling their State or Federal taxes with a 1040 form only can give themselves a pat on the back — it’s free! Everyone else not filing with a 1040 form will have to upgrade to one of the paid packages.

How does it work?

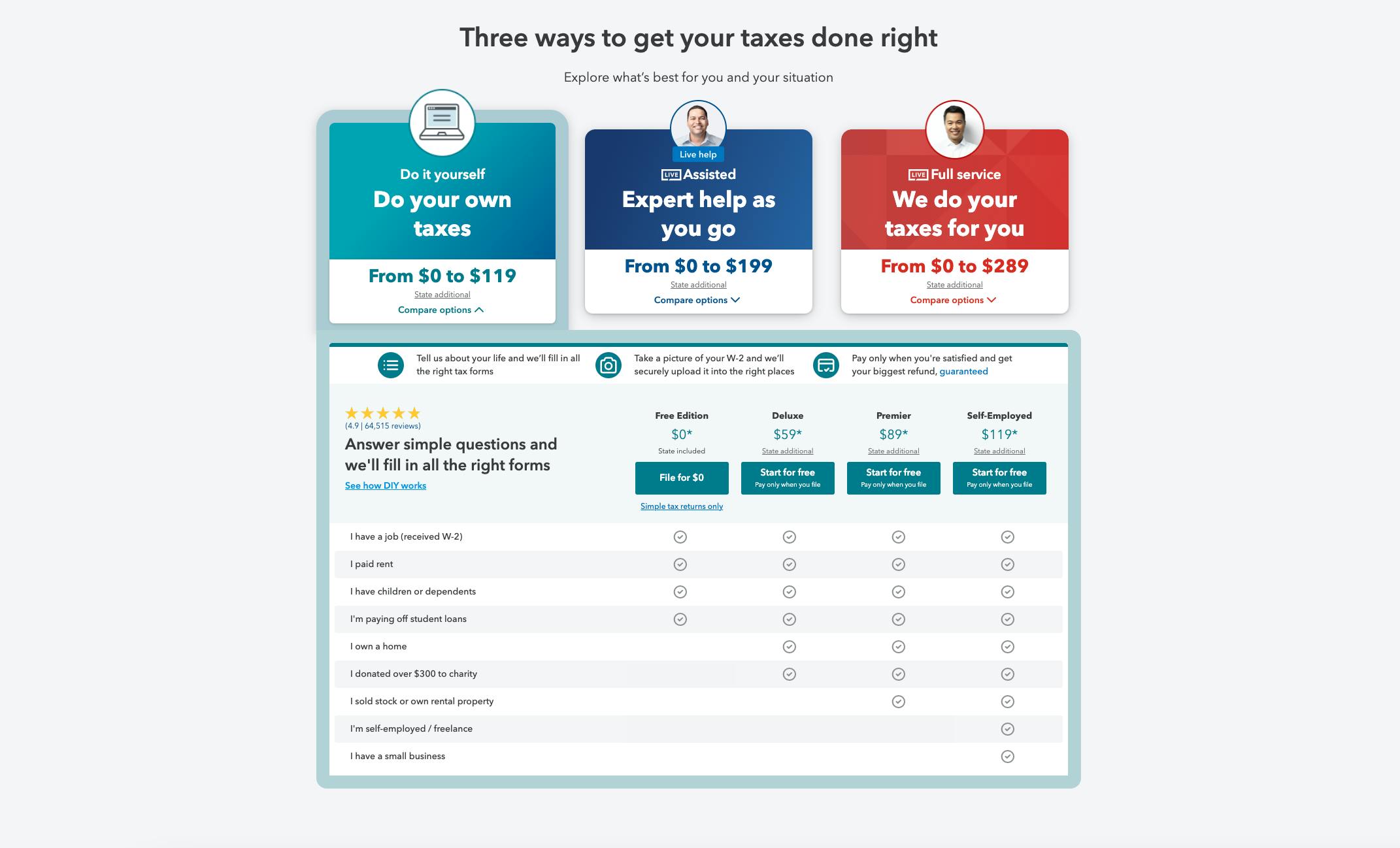

The first thing you’ll have to do is select your TurboTax package. TurboTax offers three ways to get your taxes done: by yourself, with live help, and with full-service help. Doing it yourself and getting live-assisted help cost the same amount of money. However, first-timers trying to handle this on their own might find themselves in some hot water.

Besides the assisted packages, TurboTax offers four different kinds of tax forms. They have the free edition (the most basic package), which covers individuals who have a W2 job, pay rent, have dependents, or are paying student loans.

The all-inclusive package (the most elaborate package) includes everything in the free edition but also covers individuals who own a home, have donated over $300 to charity, have sold stock or own property, are self-employed or work freelance, or are operating a small business.

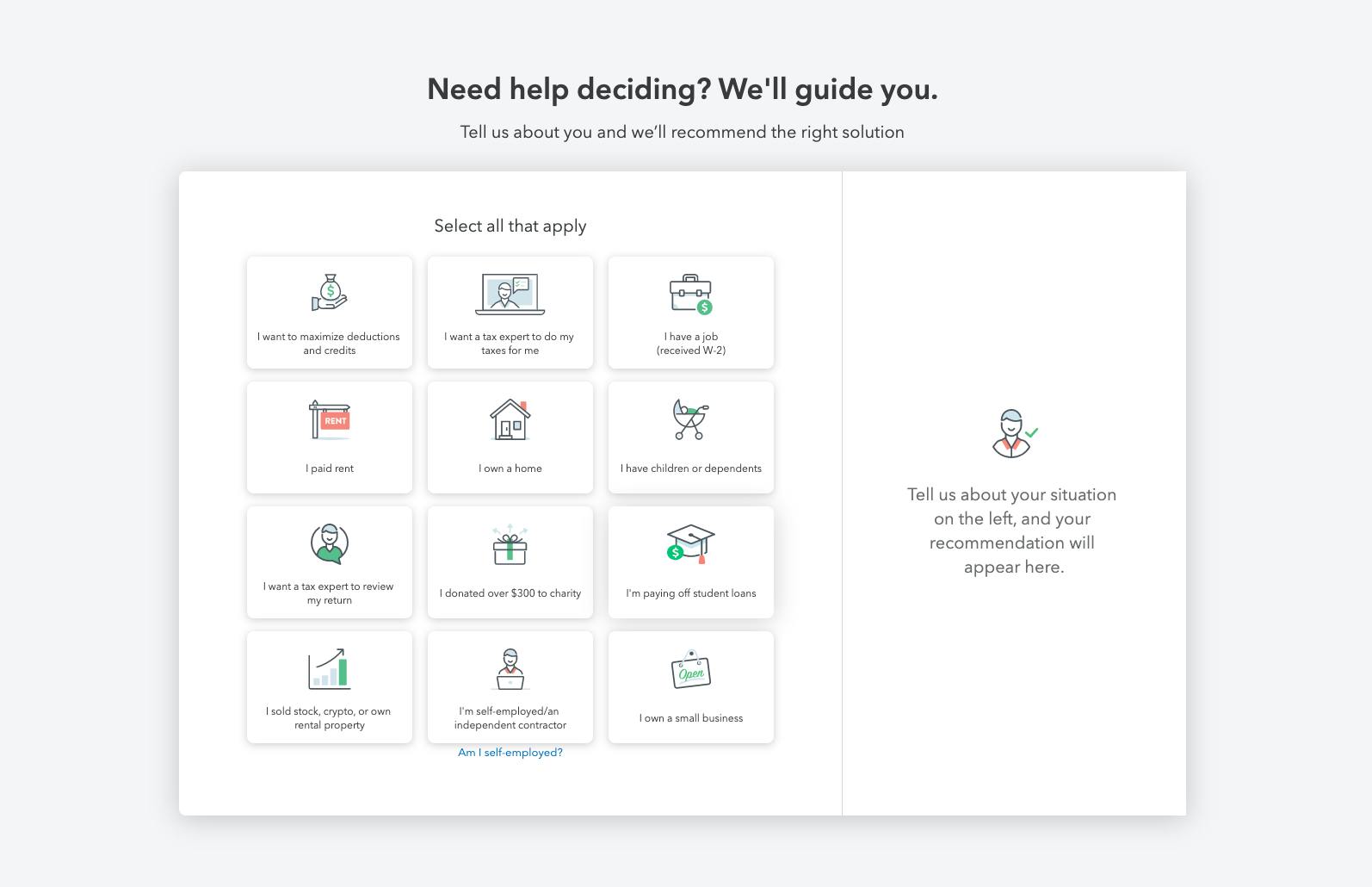

What if I’m not sure what TurboTax package to select?

Have no fear. TurboTax makes it easy to find the perfect solution for you with their simple guiding test. Simply declare whether you own a home, pay rent, and/or own a small business, and the best option for you will appear. It’s as simple as that!

Where to begin?

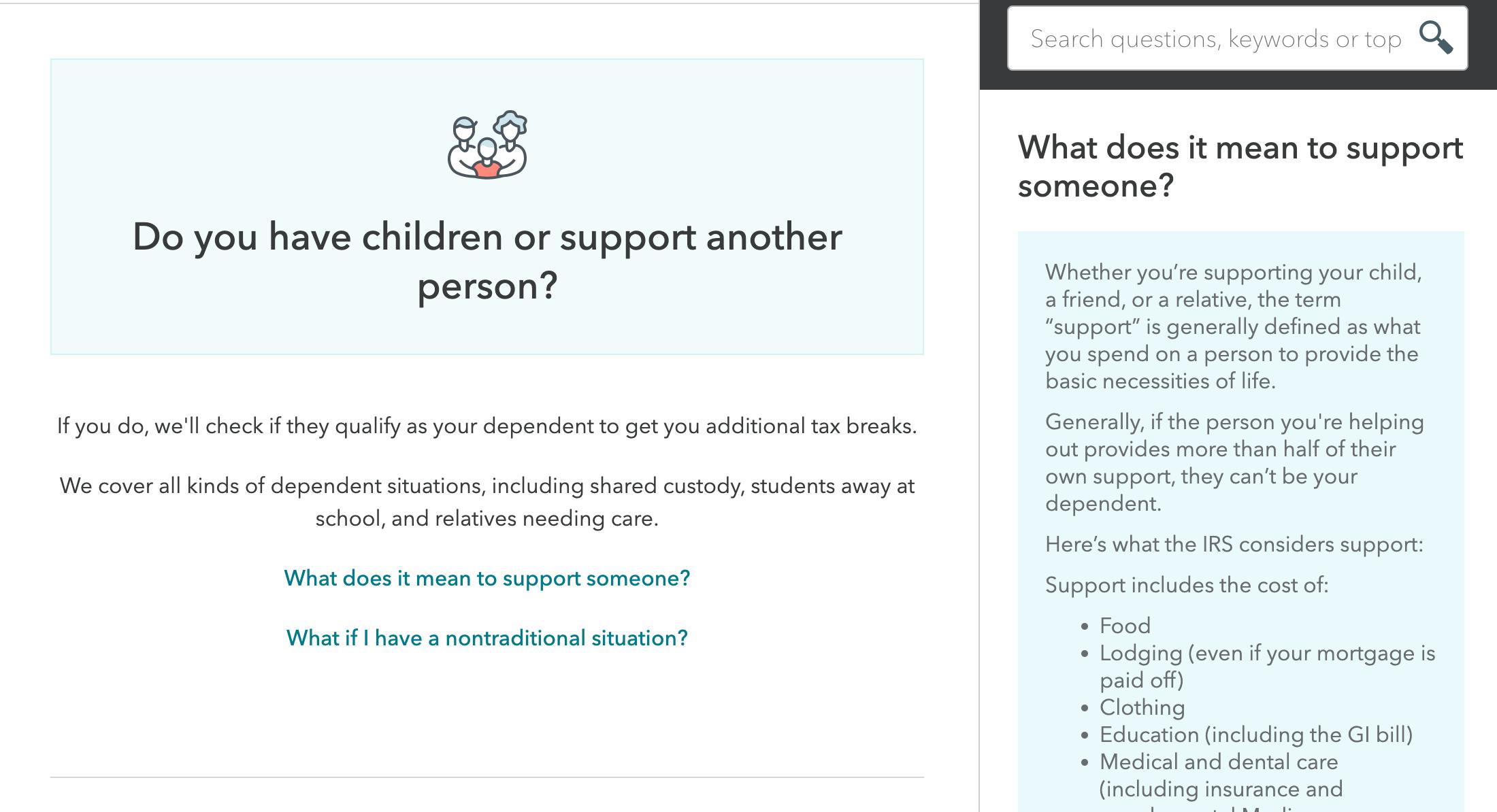

Now that you’ve chosen your package, TurboTax will walk you through a couple of prompts under ‘My Info.’ You’ll enter your first and last name, where you live, your marital status, etc. It will also ask you questions to get a clear idea of your financial status. There will be questions such as “Have you ever worked?” and “Have you ever sold or traded cryptocurrency?”.

As soon as you answer those, you’ll receive a list of all the documents needed to begin filing your taxes. TurboTax will make sure to update you with all the necessary information you may need. Whether you received a stimulus check the year before and are wondering what to do now, or if you’re wondering whether you should claim someone as a dependant, TurboTax will provide you with all the answers.

Moving to federal

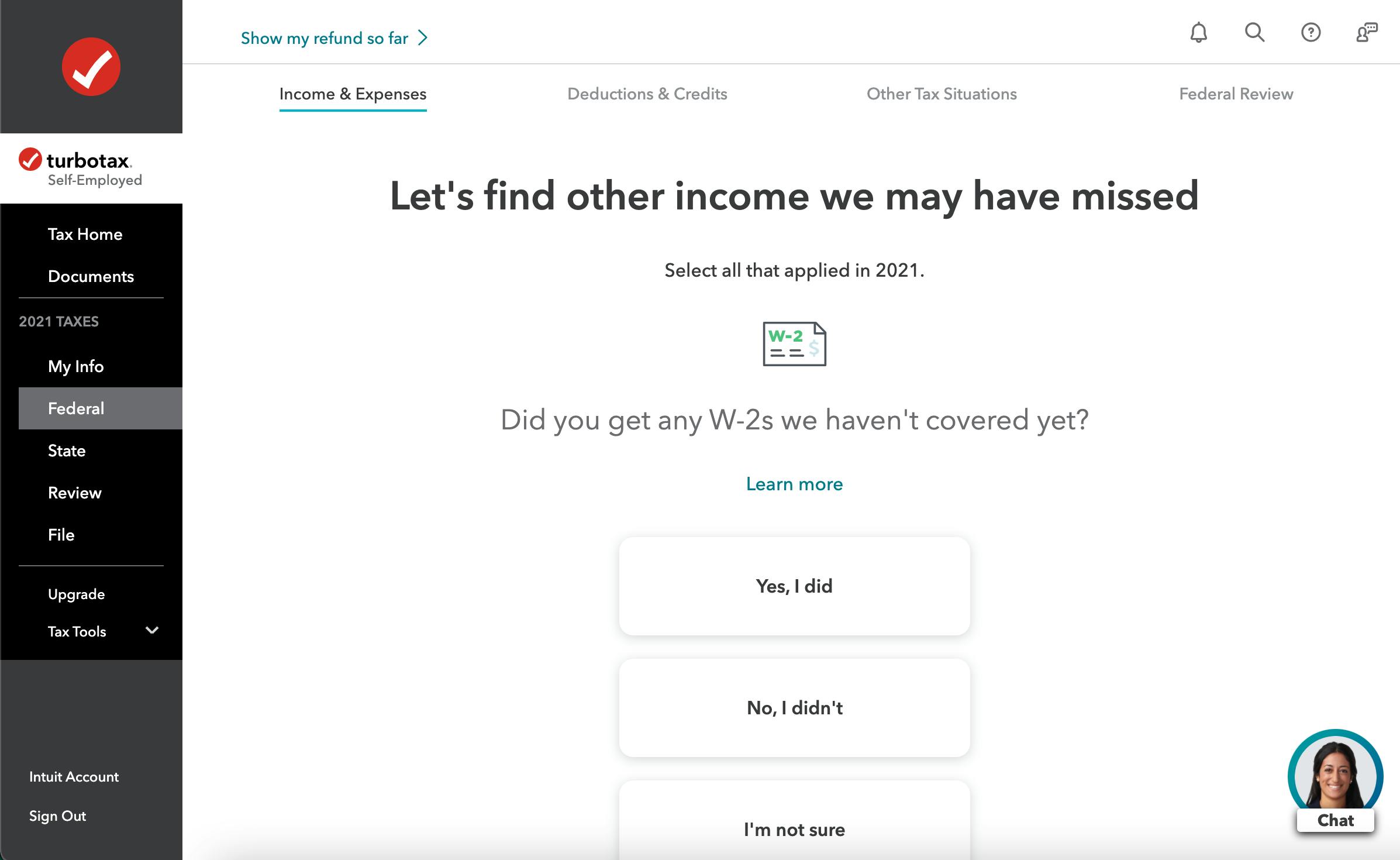

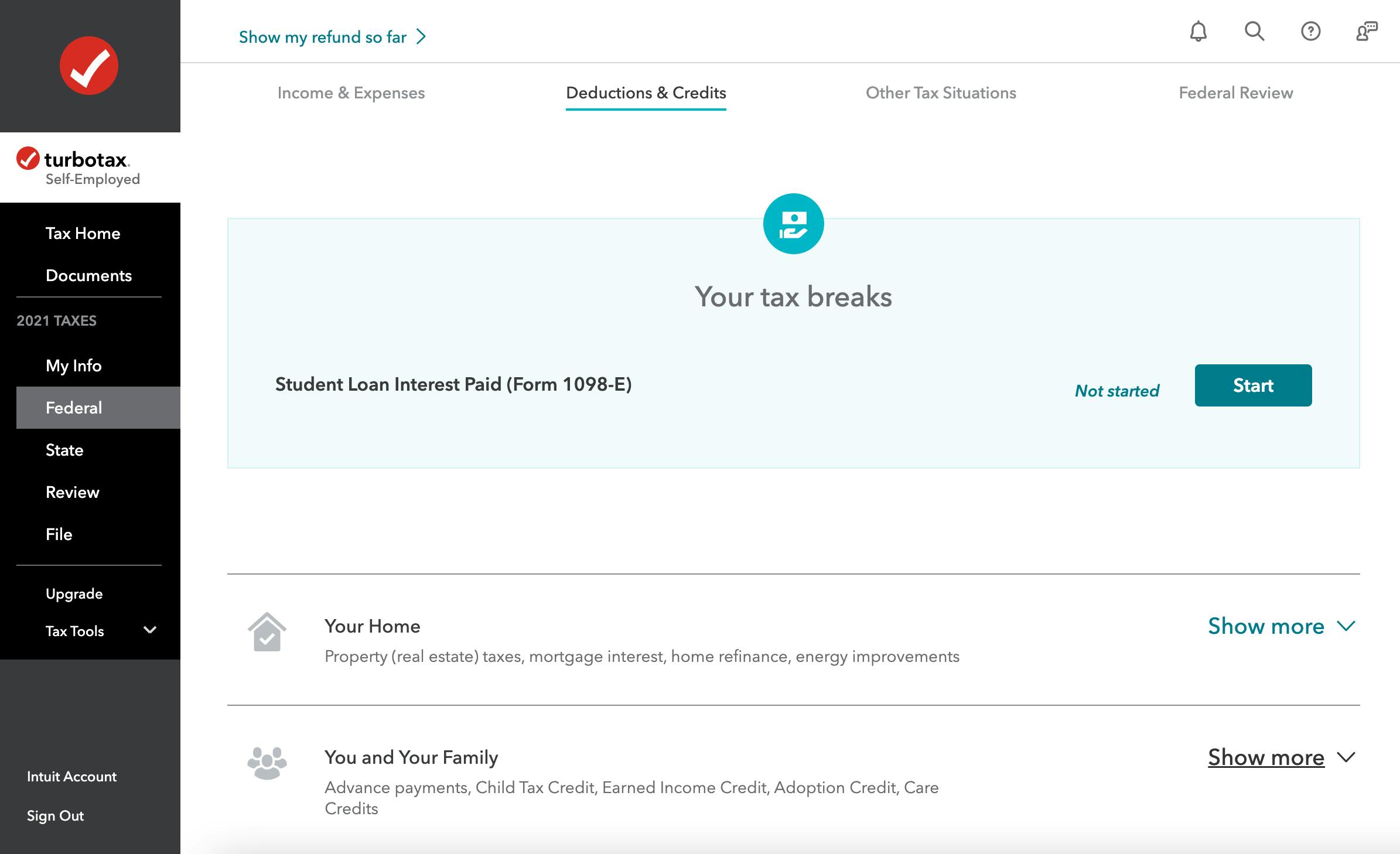

The federal tab covers everything that has to do with income & expenses, deductions & credits, other tax situations, and the federal review.

TurboTax will do a once-over to find any income you might have missed. Any W-2s, money from interest, foreign bank accounts, or financial assets that haven’t been previously listed should be flagged. From there, you’ll be taken to fill out the details for your income and expenses.

It’s important to note that this section will be different for individuals that only have W-2 employment, for self-employed individuals, and for individuals with their hands in both areas of employment.

When filing your tax breaks and deductions, you’ll see questions like “Did you get any advance Child Tax Credit payments?” and “Did you make payments on a student loan?”. After you make it past the suggested upgrades and deductions, you’ll be provided with their respective forms and taken to a page where you can add on your own breaks. You can get breaks on your home, cars, and other things you own, plus retirement and investments, and so much more.

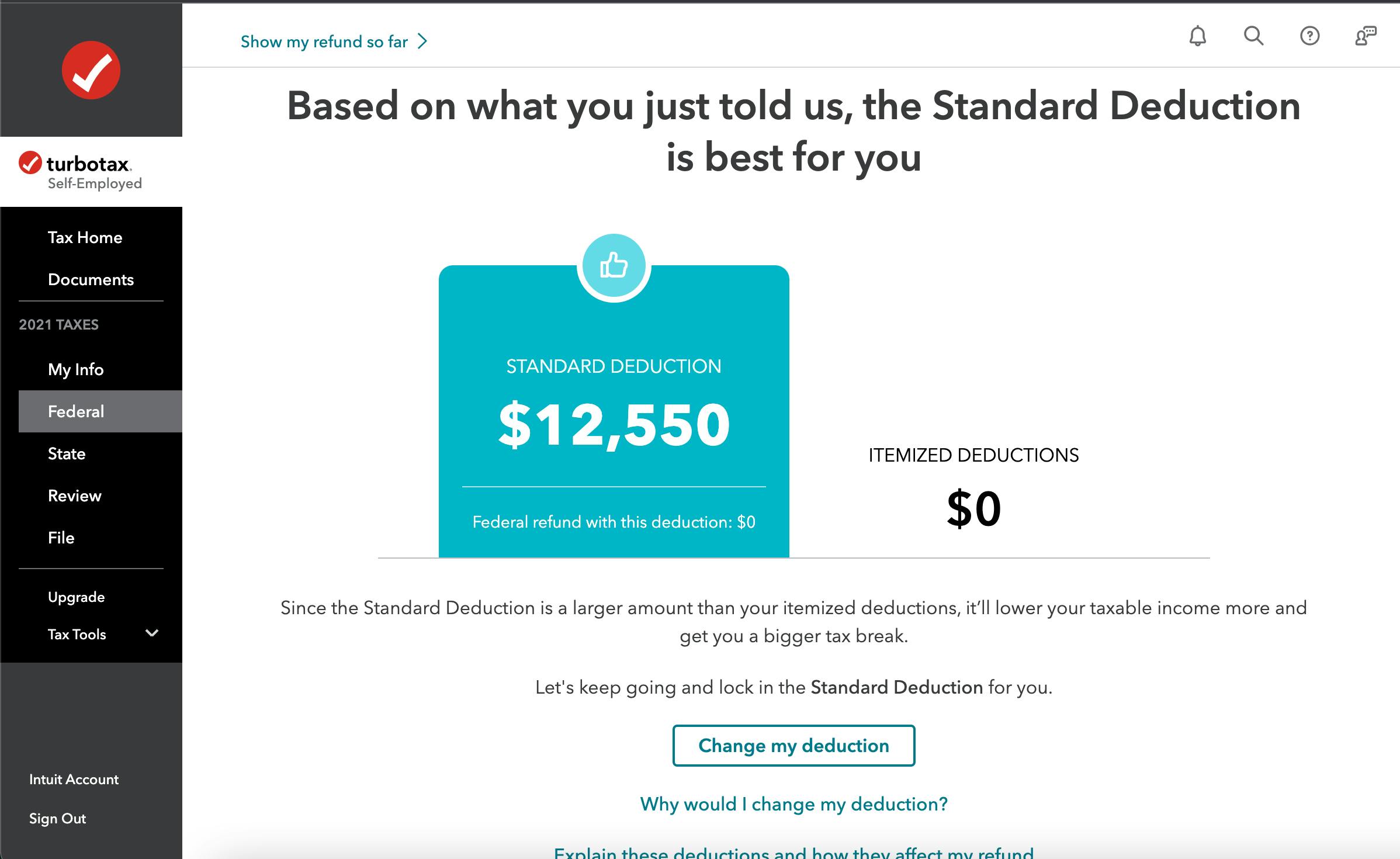

Once you wrap up your breaks, TurboTax will suggest the standard deduction that works best for you. It’ll also break down what that means for your tax return. There’s no need to worry if you see a sum that doesn’t add up because you can always change your deduction and look into why that specific number has been suggested.

What If I have some uncommon write-offs?

TurboTax has got you covered! They’ll ask you some more pre-planned questions (like if you want to donate $3 to the presidential campaign), and based on your answers, they’ll decide if you need to enter any extra information.

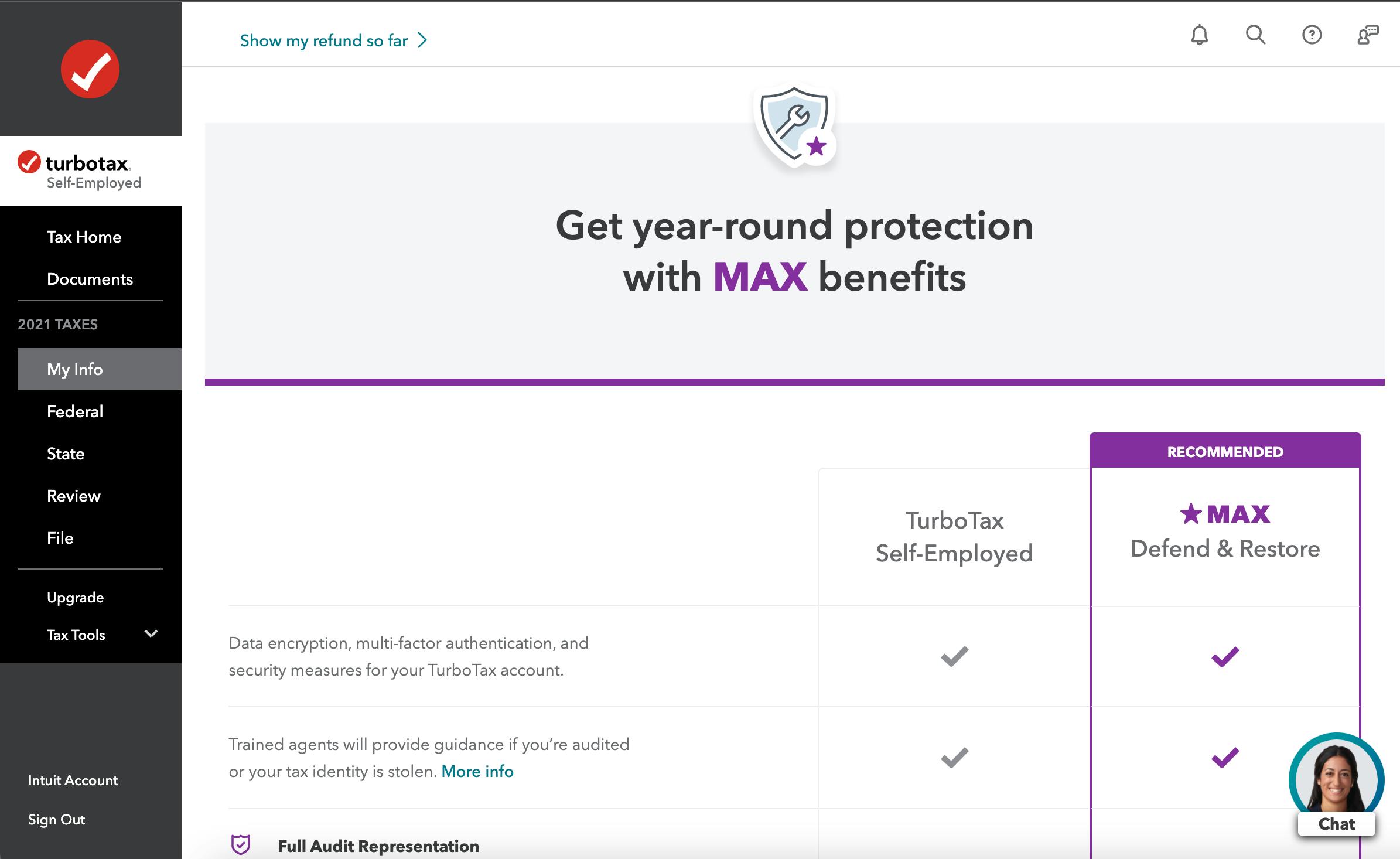

Upgrades

Get year-round protection with MAX benefits—at least that’s what they say you’ll get. For an extra $59 (valued at $125), you’ll get dedicated help and year-round protection. On top of the data encryption, multi-factor authentication, and security measures, as well as the trained agents that provide guidance if you’re audited or your tax identity is stolen, you’ll receive a couple more perks.

This upgrade will get you full audit representation, identity theft insurance, full identity restoration, and more. The best thing about this upgrade is that you can deduct this extra payment cost from your federal refund when you file. Oh, and of course, you can choose not to add on if you’d like.

Moving to state taxes

When you move to your State taxes, TurboTax will do three things — bring over all the info from your Federal taxes, search for tax breaks, and make sure they’re accurate. Of course, depending on your individual State of residence, you may or may not have to complete this step. For example, I’m filing my taxes for Florida, but there’s actually no personal income tax or intangible tax in Florida.

According to TurboTax, this State return, the Tangible Property Tax Return (DR-405), is only for business and rental property owners with assets (office furniture, computers, etc.) located in Florida. Tangible property tax returns are required in Florida only if you own a business or own a rental property with assets (other than vehicles); or if the assets are located in Florida.

If you happen to meet the above criteria, you’ll have to request a Florida Tangible Property Tax Return. If not, you can simply skip this step.

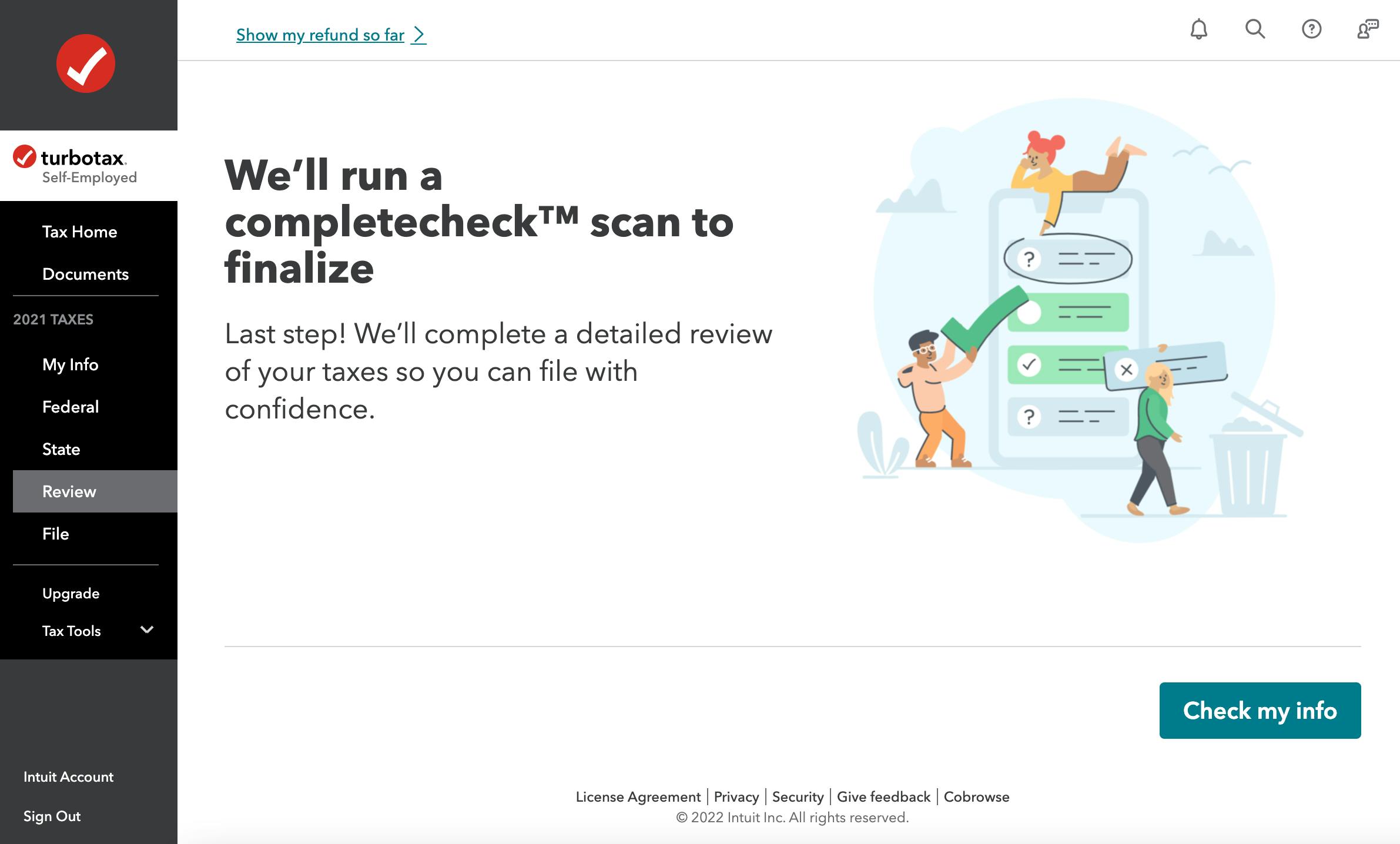

When you’re done with federal and state taxes

TurboTax’s last step before filing is a scan to make sure you—as well as they—have checked all the bases. If there’s anything missing, you’ll be notified and brought back to fill out or re-enter any info that doesn’t quite add up.

TurboTax review: My personal experience

My own personal experience with TurboTax wasn’t pretty, but it wasn’t terrible either. Let me begin by saying that my situation is very unique. I am both a W-2 employee and a freelancer. I also spend six months in two different states and own property in one of them. Because of this, I filed with the “Self-employed” TurboTax package.

For the first time filing my taxes, relying solely on TurboTax’s prompts was a little too hard, especially with my unique set of complications. For a while, my total refund was adding up to $0. I realized that I wasn’t filing with the right state and didn’t have the right information for my W-2. Plus, having to wait for the Florida Tangible Property Return was a little bit of a hassle but unavoidable in the end.

However, after a couple more prompts and a quick call to my dad, we got it all sorted out. It was a pretty fast track to the finish line after that! All in all, TurboTax did a great job organizing the information in a manner that was easy to understand and even easier to fact-check. My only warning would be to have all your documents gathered beforehand—which is something I learned the hard way.

If you’ve got someone in your life that knows their way around a tax return, good for you. I’d recommend you get their help to collect those documents for you beforehand. Of course, for anything else out of the ordinary, you’ll have to consult your TurboTax prompts.

Should you use TurboTax?

If you’re filing your taxes for the first time and you’re looking for a quick and easy way to get them over with, I would definitely recommend TurboTax. Even if you find yourself needing a little extra help. Remember that you can select the live assistance offer for no extra charge.

If you’re like me, and you’ve got a pretty crazy situation going on with your taxes, the basic package might not cut it. I would suggest going with either the live assistance (if you’ve got a little bit of experience) or the full-service package for first-timers. Happy tax szn, ya’ll!

The Daily Dot may receive a payment in connection with purchases of products or services featured in this article. Read our Ethics Policy to learn more.