Sony is the latest brand that wants to turn cord-cutters into TV subscribers by offering a new, yet-to-be-released cloud-based TV service. Inking a deal with Viacom to distribute its content gives Sony a leg up on Dish Network and others in this nascent market.

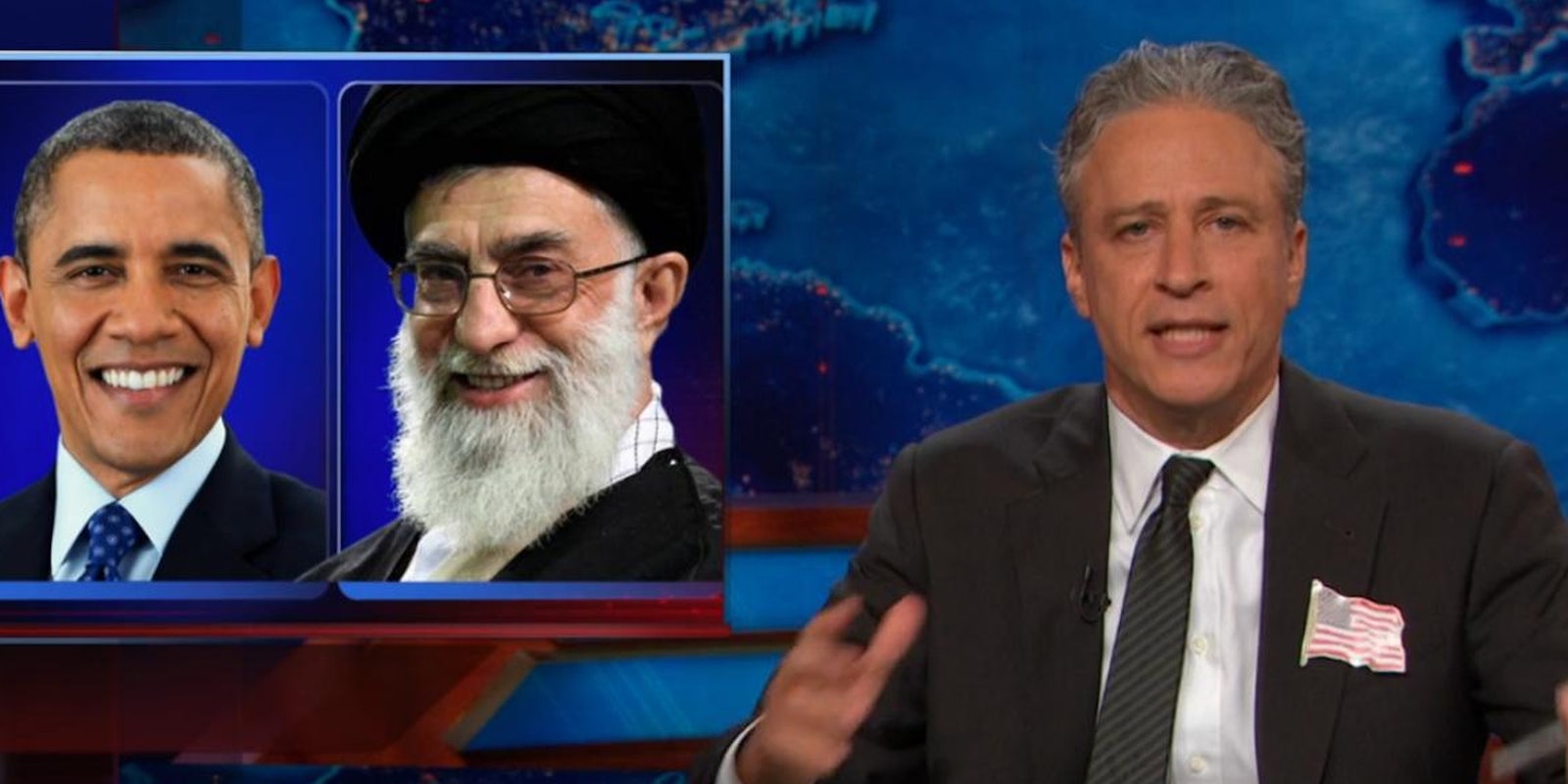

No financial terms were announced for the deal between Sony and Viacom. Sony will have the distribution rights to Viacom programming as well as access to Viacom’s TV Everywhere websites and apps, and Viacom’s full video-on-demand package. Viacom’s networks include Comedy Central (The Daily Show), BET, MTV, Nickelodeon (SpongeBob), Spike and Logo.

Viacom has a distribution deal in place with the streaming network Hulu which is owned by NBC, Disney, and Fox. The deal ends in late 2014 and seems unlikely to be extended given Disney’s cloud TV deal with Dish Network and Comcast’s (the nation’s largest cable provider) ownership of NBC.

Andrew House, the chief of Sony Computer Entertainment, first announced his company’s intention to offer a cloud-based TV service at CES 2014 with little detail about price, launch date, and distribution. The Sony Playstation could evolve into a living room gaming and entertainment hub with great appeal to young, digital cord-cutters; it would offer gaming, Blu-Ray, and a streaming center. The new service could logically also be distributed via Sony TVs and may give the consumer electronic company a boost in sales of its Internet-connected HDTV line. The Japanese company is third behind Samsung and LG in that important category.

Sony’s proposed service differs from Dish in that it includes live over-the-air TV broadcasts. The Sony offering could accomplish this via a branded hybrid set-top box that receives HD over-the-air channels from TV local networks to complement streamed channels. Because the deal with Viacom lacks specifics, the live content could be limited to linear programming from Viacom’s networks which would compete directly with cable providers.

With Sony and Dish in the cloud TV game, a next step could be in a race to bring premium networks such as HBO and Showtime into the fold. Such a move would require a large cash outlay to services such as HBO. HBO receives approximately $7 per subscriber from cable providers, which generates about $3 billion in yearly revenues. So with a market cap of $20 billion, Sony has the money—are they willing to spend it?

H/T CNET | Screengrab via Hulu