Less than a month out from the 2024 presidential election, polls are tight in the race between Vice President Kamala Harris and former President Donald Trump.

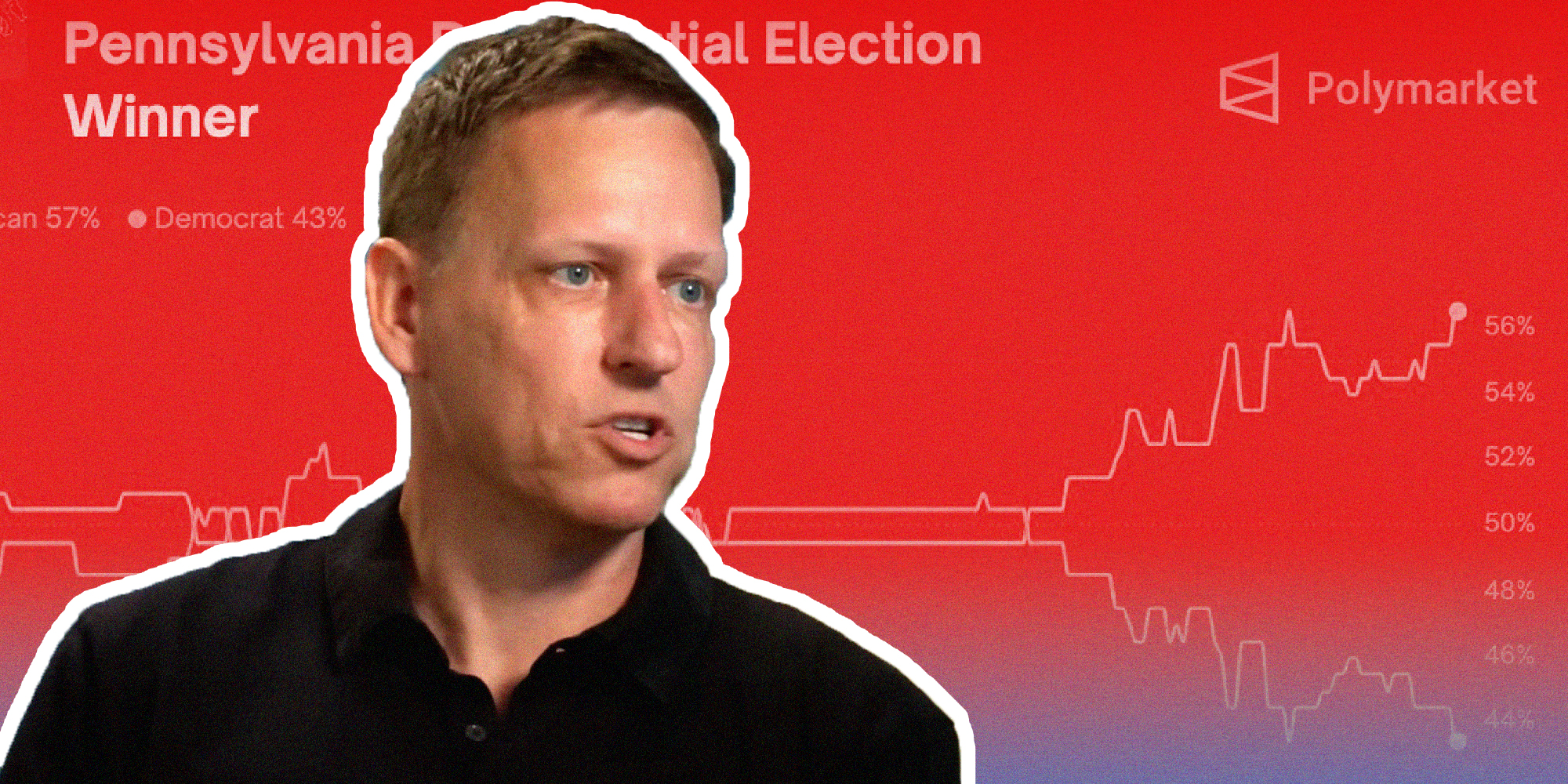

But over on prediction markets, the gap between Harris and Trump widened recently. On Polymarket, a crypto-fueled offshore marketplace that offers bets on the presidential election, Trump has jumped out to a huge lead.

Another market, Predictit, is favoring Trump as well, but by a narrower margin.

Trump’s massive lead on Polymarket has some convinced the site isn’t running a crypto betting pool, but rather an election influence operation, setting the stage for Trump to take office regardless of the results in November.

The market there shows a 55% chance he will win and a 44.6% chance Harris will lose. For each candidate, gamblers can buy “yes” or “no” votes based on who they think will win or lose.

Those predictions have been boosted recently by conservative influencers online as proof that Harris’ campaign is flailing.

But some liberals are pushing back against Polymarket as "proof" of shifting voter sentiment, pointing to the fact that it was funded by a key Trump booster.

In the run up to the US election, the ONLY opinion poll giving Trump a clear lead is unregulated crypto bullshit bets #Polymarket, funded by Peter fucking Thiel.

— GET A GRIP (@docrussjackson) October 7, 2024

The wankers pushing this antidemocratic shit should be in jail.

Every major recent poll puts Harris slightly ahead. https://t.co/mjhO0evjTQ pic.twitter.com/vZuJyTBw82

In May, Polymarket announced it raised $70 million in two recent rounds of investment, with a big boost coming from Founders Fund, a venture capital outfit led by Trump 2016 backer Peter Thiel.

Thiel has been a crucial funder of Trump’s vice presidential pick Sen. J.D. Vance (R-Ohio) over the years. Vance worked for Thiel in 2017 and Thiel funded Vance’s own firm Narya Capital in 2020. In 2022 Thiel donated $15 million to Vance’s successful Senate race in Ohio.

Thiel, who previously spoke out against democracy, has declined to publicly support any candidate in 2024. Vance reportedly has been pressuring him to donate to Trump.

Online, some people are pointing to the jump in support for Trump on the prediction market as evidence that Polymarket might be putting a heavy finger on the scale to create a narrative of inevitability about Trump getting elected.

Others say that even if the strategy doesn’t result in a Trump victory, it could lay the seeds for a narrative that the election was rigged against Trump.

“Polymarket is owned by Peter Thiel,” posted @Cmmnsensedspnsr on X. “The same Peter Thiel who is personally backing JD Vance and many other conservative causes. Polymarket is not independent, not unbiased, and skewing its data to favor one person over another.”

“connect the dots: GOP Russian link backer Peter Thiel funded Polymarket, which is banned in the US, and hired @NateSilver538 ahead of the election to create an 'alternate' narrative about election being widely favored 4 Trump. This narrative would then be picked up by right-wing,” added @SomaliAmerica, referring to former FiveThirtyEight founder Nate Silver, who joined Polymarket in July.

Silver has also been a left-wing boogeyman over the years and sparked ire earlier this summer when he released his new election model predicting Trump would win.

Betting on elections is against the law in the United States, which is why Polymarket operates offshore. In 2022, the Commodity Futures Trading Commission (CFTC) fined Polymarket $1.4 million for operating illegal event markets.

In 2023, some Democratic senators wrote a letter to the CFTC warning another prediction market called Kalshi could potentially impact the election.

“Billionaires could expand their already outsized influence on politics by wagering extraordinary bets while simultaneously contributing to a specific candidate or party,” they predicted. “These bets could sway the outcome of our elections, undermining the voices of voters. If citizens believe that the democratic process is being influenced by those with financial stakes, it may further exacerbate the disenfranchisement and distrust of voters already facing our nation.”

Volume on Polymarket for the election is over $1.8 billion, and a plurality of it is coming from the Trump side. Gamblers spent $500 million on votes on Trump, and just over $370 million on the Harris side.

That’s led some people to point to some of the biggest movers in the markets as potentially buying shares for Trump to distort the market in his favor. One user, Fredi9999, has over 14 million yes shares as of Monday afternoon.

“The user is a fervent and wealthy supporter, crypto & tech savvy, who wants to back up his belief that Trump will win with a lot of money,” posted @Domahhhh last week about Fredi, when he had around 8 million shares.

Wrote one about the numbers, “This smells like desperation. A single whale can shift the odds dramatically on polymarket. They're simply laying the groundwork for another ‘stolen election’ narrative,” they said, flagging Elon Musk's tweet that called Polymarket “More accurate than polls.”

Others were similarly convinced that the market movement was part of a plot.

“Political betting markets have always been skewed to the right, but now the billionaires are actively manipulating them to create the illusion that Trump has a clear advantage so that they can claim that the election was ‘stolen’ cheated if/when he loses,” posted @BostonJerry.

But other posters were more sanguine and viewed the prediction narrative as a distraction.

“People need to get out and vote and not pay attention to this nonsense — the veracity of their ✌🏽”polling”✌🏽 is beyond questionable,” wrote @rwiley55.

Internet culture is chaotic—but we’ll break it down for you in one daily email. Sign up for the Daily Dot’s web_crawlr newsletter here. You’ll get the best (and worst) of the internet straight into your inbox.