Facebook was on the verge of scrapping its $104 billion initial public offering (IPO) in 2012 after receiving poor revenue projections, according to court testimony in a class-action lawsuit.

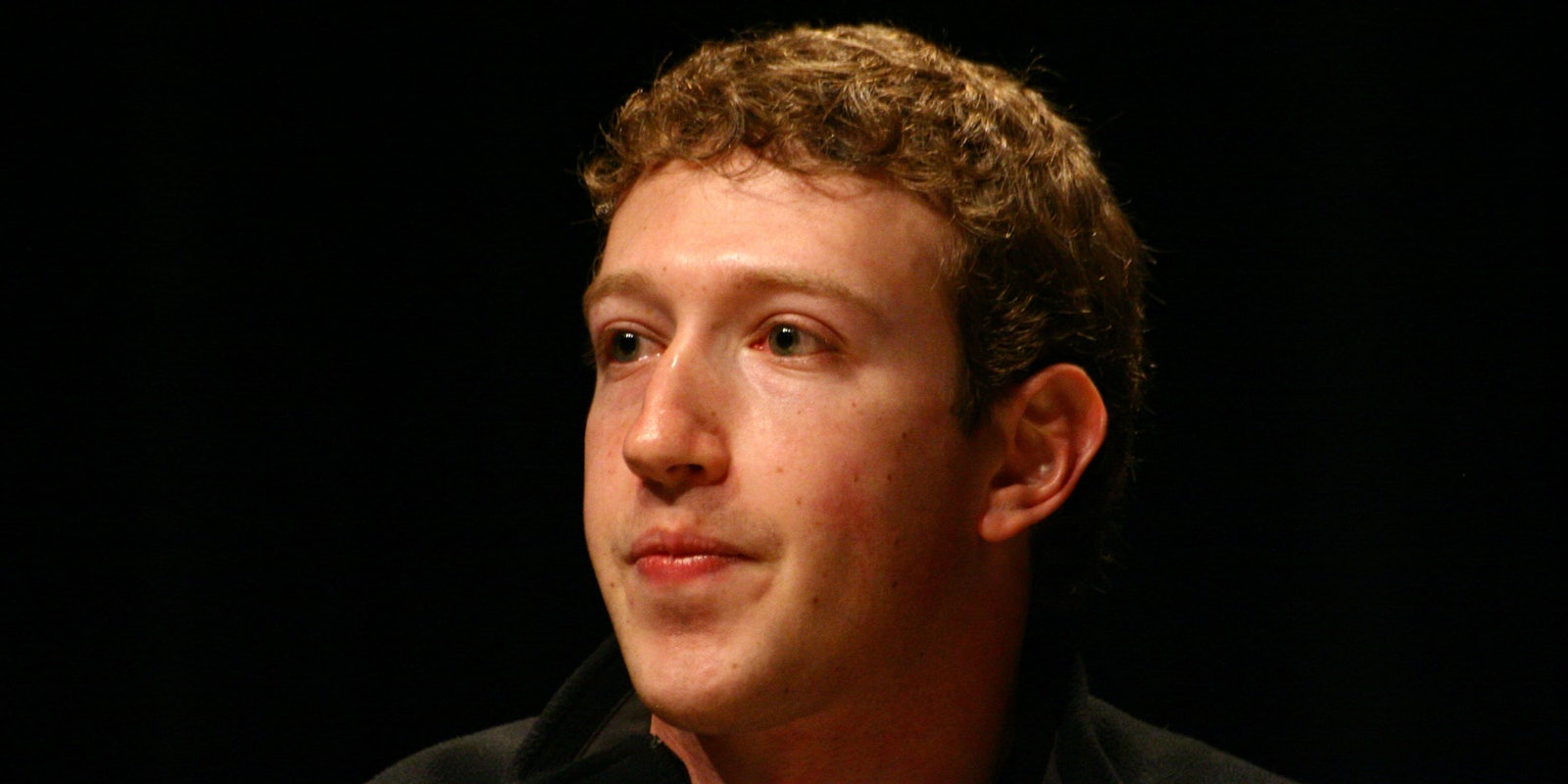

The stress of the IPO even got the best of CEO Mark Zuckerberg, who texted his wife Priscilla Chan in fearful panic.

“Everything here is going really badly. Our revenue projection has gone down so much we now think we might go public at less than $50bn if things continue,” the text said, according to the Financial Times.

The IPO came at a pivotal moment for Facebook, which was fighting to move its platform from desktop to mobile and had spent $1 billion to purchase Instagram—an acquisition now considered one of the most “brilliant” in tech history.

Facebook is the most successful social media platform in the world, but the days leading up to the IPO were less than convincing. In May 2012, Zuckerberg and co. started a pre-IPO roadshow to win the favor of investors. Things got off to a “rough start” after investors were forced to watch a 30-minute video pitch. Zuckerberg also got flack for wearing his signature hoodie instead of a snazzy business suit.

“Mark and his signature hoodie. He’s actually showing investors he doesn’t care that much, he’s going to be him,” Wedbush Securities analyst Michael Pachter said on Bloomberg TV. “I think that’s a mark of immaturity.”

Facebook was treading water by the time the $104 billion IPO came around. But after a “huddle” with execs, Zuckerberg chose to move forward, texting his wife, “The IPO is on.” Her reply, “Yay.”

Unfortunately, Zuck was right: Things were going really badly; investors ended up suing him for violated securities laws by not disclosing that the move from desktop to mobile was affecting revenues.

Andrew Clublok, a Facebook legal representative, is now arguing that it isn’t possible to quantify those risks and that the social giant’s revenues quickly rebounded.

“We remain confident that our disclosures were complete, accurate, and complied with applicable law,” a Facebook spokesperson told the Financial Times.

H/T Mashable