To those wondering if you have to pay taxes on Bitcoin, billionaire and cryptocurrency champion Mike Novogratz issued a blunt warning at the Bitcoin conference last June.

“Listen, the IRS is going to come after people,” he told the crowd. “People are making real money now. So the IRS isn’t stupid.”

As the April 18 deadline approaches, many cryptocurrency investors are facing the same cold-hard truth: Even if your currency is decentralized, you still have to pay taxes on it. And yet, many are choosing to look the other way.

Earlier this week, Credit Karma announced that, of the 250,000 people who have already filed their returns with the credit-checking service, fewer than 100 Americans reported any cryptocurrency gains to the Internal Revenue Service. That figure stands in stark contrast to a survey conducted on the site that found 57 of Credit Karma users also have cryptocurrency gains. Roughly the same percentage admitted they had never reported cryptocurrency gains to the IRS, while less than half of those polled said they understood how owning cryptocurrencies like Bitcoin and Litecoin affected their taxes.

Yes, adulting is hard—especially when you’re trying to overthrow capitalist institutions that undermine globalization with life-changing technology. But whether you became a cryptonnaire or lost big on that alt-currency you went in on, you still have to tell Uncle Sam. Here’s our basic guide to paying taxes on cryptocurrency.

Disclaimer: This is not tax advice. Go see an accountant to answer your major questions.

10 tips on how to pay taxes on Bitcoin and other cryptocurrencies

1. Anytime you trade a cryptocurrency for a fiat currency, you’ll have to pay taxes on it

This includes…

- Converting crypto to USD with a profit (you bought in low and sold high)

- Converting crypto to USD with a loss (you bought in high and sold lower than your purchase price)

- Converting crypto to EUR but you live in the U.S. and pay taxes in the U.S.

- Sending crypto to a friend or using it to buy a product, even if it was a “loss”

2. If you just bought crypto and then held onto it, you should be good

Until you move your crypto assets out of a digital wallet into cold hard cash or you use it to buy something, you won’t have to pay taxes on them. Relax, hoarders: You’re good… for now.

READ MORE:

- Why IOTA could be the next Bitcoin

- The most popular Bitcoin scams—and how to avoid them

- How to buy cryptocurrency (in simple terms)

3. How much you’ll pay in taxes depends on when you sold it

If you sold your crypto less than one year after buying it, and profited, it’s considered a short-term gain. For short-term gains, you’ll be taxed at your regular income tax rate, based on how much you make. For example, if you bought $1,000 of Bitcoin (BTC) in January, but sold it in May when it hit $2,000, your “realized gain” is $1,000. If your tax bracket is 25 percent, then you’d owe $250.

If you sold your digital currency after holding it for over a year, you’d be taxed at the long-term capital rate, which is typically 15-20 percent. Irritating as ever, the IRS rewards patience with lower tax percentages.

4. Losses can be a good thing (sometimes)

If you invested in alternative currencies, it’s entirely possible that you took a loss in 2017. With volatility shaking buyer confidence, it’s totally feasible you bought an altcoin and immediately regretted it when it started to tank. Taxpayers can use losses to offset capital gains or up to $3,000 of ordinary income. Anything above that will roll over each year until the remainder is depleted.

To calculate your losses, just subtract the sale amount from the basis. For example: If you bought $200 worth of Ethereum (ETH) but sold it at $100, you can deduct the $100 loss from your capital gains.

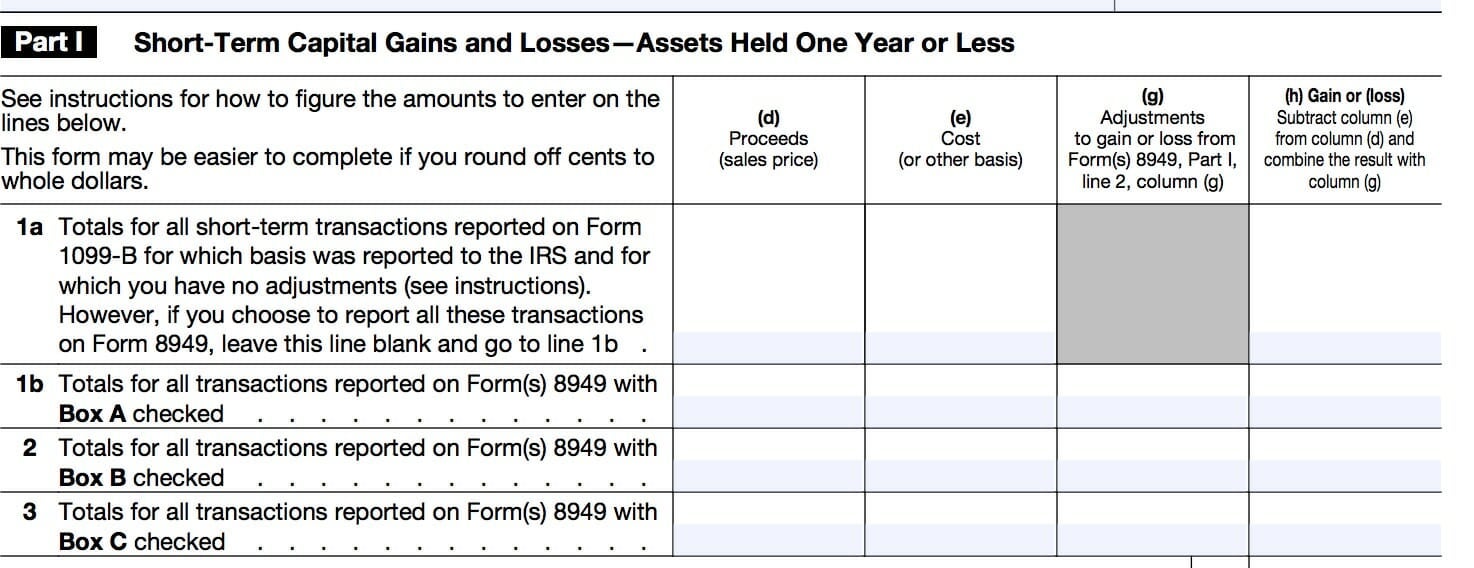

5. All of this Information Goes on Form 8949 and Schedule D (1040)

You’ll have to use 8949 to add it all up line by line, and Schedule D to report the gains and losses.

6. If you used one crypto to buy another, you’ll probably have to tell the IRS

Unfortunately, the government just closed a loophole on this very situation with new regulations on reporting these sales. This prevents people from “sweeping” crypto assets under the rug by just buying new altcoins every time it’s tax season. Since the IRS treats cryptocurrency as property and not currency, crypto-to-crypto exchanges are now taxable. You’ll have to calculate your gains and losses from every time you bought and sold that crypto and the equivalent USD price at the time. This is a huge pain, and you’ll definitely want to give yourself enough time to go through every transaction carefully.

7. Miners are self-employed

If you successfully mined Bitcoin or any other digital currency this year, you must report the fair market value of your crypto on the day you received it, and report it as income. Miners are also required to pay self-employment taxes since typically mining results in income tantamount to owning a small business.

READ MORE:

- Why critics are skeptical of TRON, the buzzing cryptocurrency

- How to invest in Bitcoin (without losing your shirt)

- Why Ripple, the Bitcoin alternative, could be huge

8. You can be a Bitcoin philanthropist, but it might be too late

Donating cryptocurrency or other USD profits made from cryptocurrency is a beautiful idea, but don’t expect it to make a difference in the form of a tax break this year. This New York Times piece has some ideas for crypto investors looking for ways to give away their BTC and other currencies.

9. Download your own forms

It’s a cold, hard crypto world out there. Don’t expect to receive forms in the mail from exchanges like Coinbase or other digital wallets, unless you’ve received over $20,000 in sales. In that case, you’ll get a 1099-K form. Coinbase does make it easy for traders by providing a concise list of transactions emailed to you in a PDF. You’ll have to go to this page to learn how to generate these PDFs, however.

10. Don’t risk it

Don’t play audit roulette this year. While it’s unlikely (unless your returns are particularly strange or you’re a millionaire) that you will get audited, it can happen to you. Cryptogains or the lack of reporting them may trigger an audit since the IRS is reportedly on the hunt for them this tax year. And if you do get audited, relax… You’ll get through it. Especially if you’re sipping tequila on your cryptocurrency-purchased yacht.