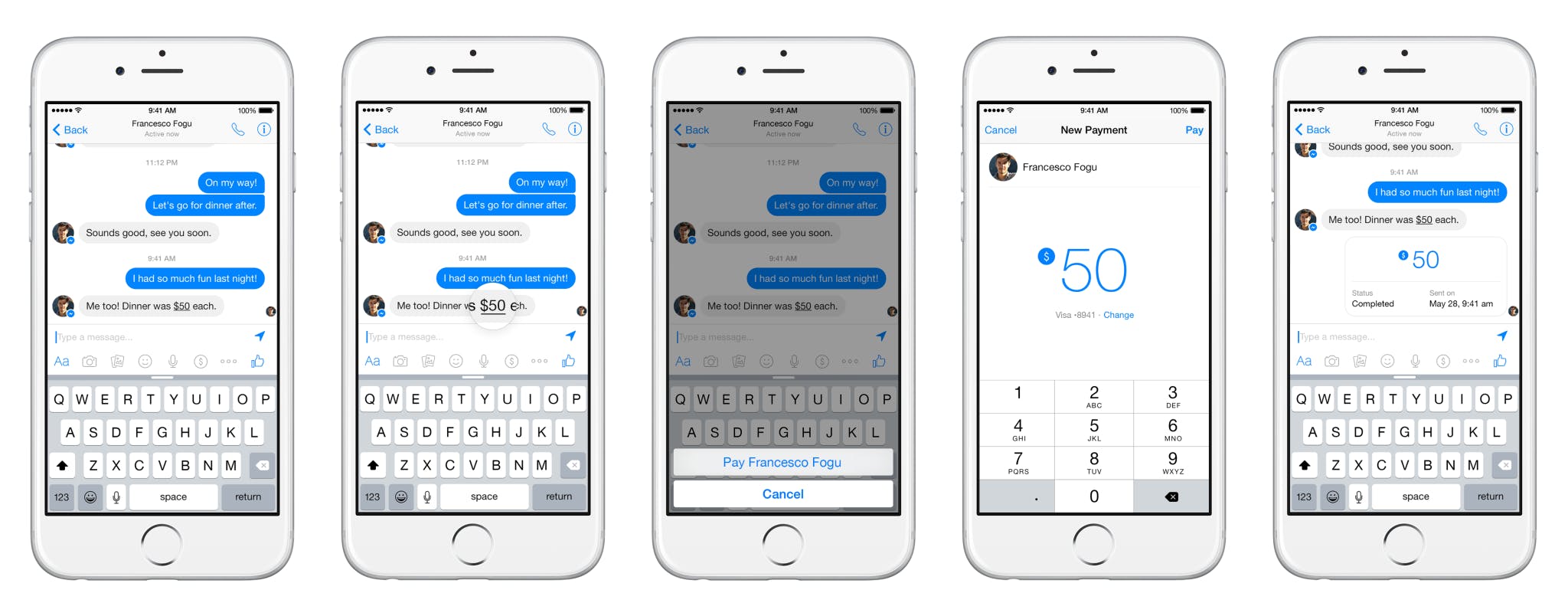

Facebook wants you to use its messaging service to send your friends more than text messages. The company launched Payments for Messenger in March, and its slow rollout is continuing across the U.S. It is now available today in New York City and surrounding areas.

Wednesday’s update also includes a handful of changes that improve the way people can send and receive money within Messenger.

Dollar amounts will become hyperlinks, and when the person taps the link, it will create a payment for the person you are chatting with. Before money exchanges hands, you’re asked to confirm it first.

Additionally, Payments now work in group chats—similar to how Venmo has a running list of payments both from the public and from friends, anyone in the chat will be able to see who has paid whom how much.

Facebook is taking its time making Payments available for everyone. Smaller cities across the U.S. including Seattle, Austin, and Portland have had access to Payments already, and Facebook is continuing to phase other cities into the mix. But if you have a friend in one of those cities, simply ask them to send you a payment. Anyone in the U.S. can start using the feature after someone initiates a transaction.

Facebook’s Payments feature is competing with a number of other social payment applications in an effort to make it easier to exchange money on iOS, Android, and the Web. Paypal-owned Venmo and Square Cash are already popular for sending and receiving money, and Snapchat has even tried to get into the mix with Snapcash.

But with 600 million Messenger users, Facebook already has a built-in audience for sending and receiving money, so it might make it easier to grow. And Payments is just one of the many features Facebook is adding to its standalone messaging service in an effort to turn it into a full-fledged platform, not just an app.

Where Facebook might run into some trouble, however, is getting users to trust the company with their money. According to a recent Pew Internet study, some 69 percent of adults don’t trust social networks to keep their data private and secure. Of course, we continue to use them all anyway.

Illustration by Max Fleishman