If you’re one of the 143 million people impacted by the massive hack of credit monitoring firm Equifax, you may be gunning to join an American tradition: suing the hell out of somebody.

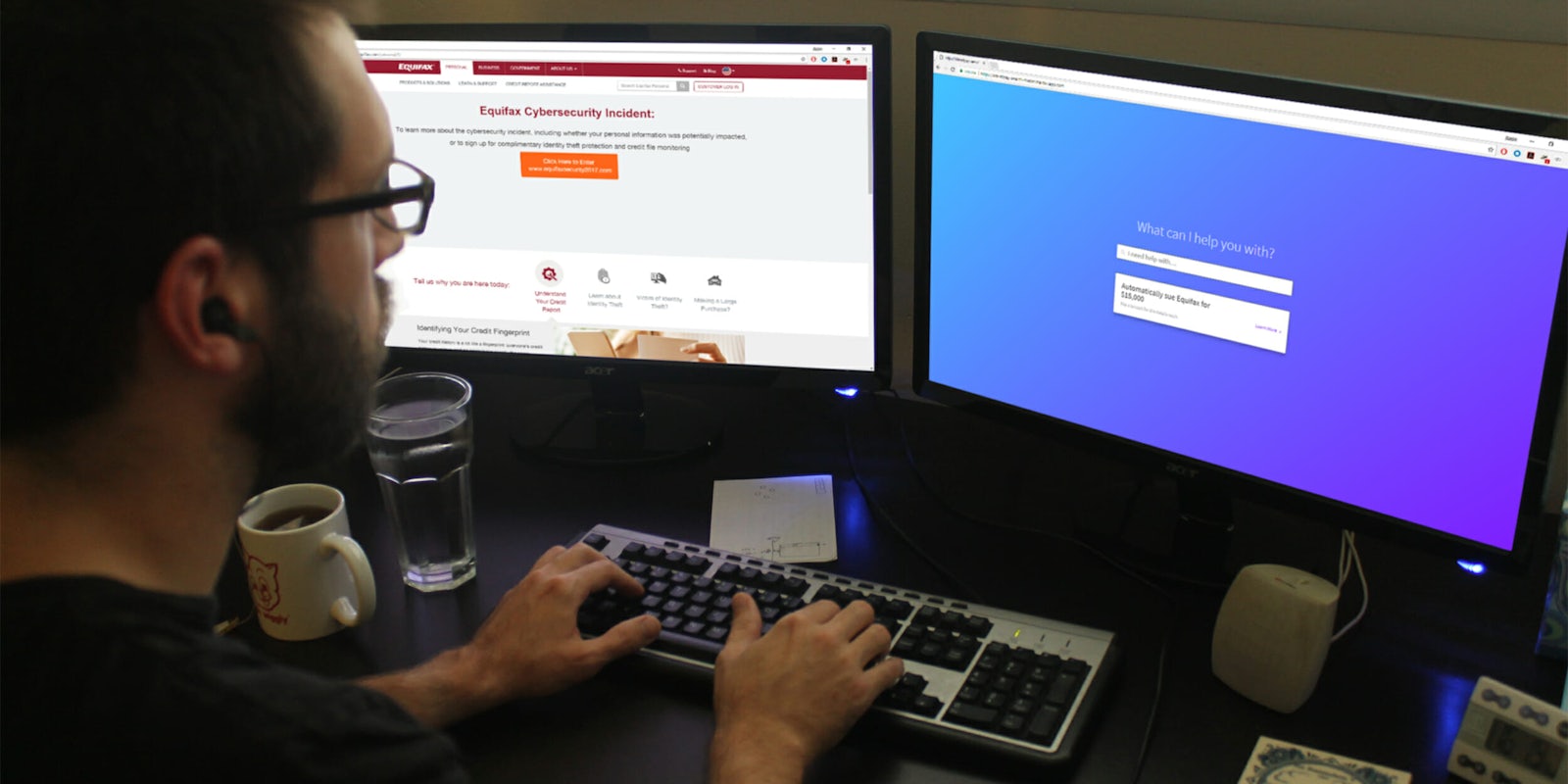

Thanks to a clever chatbot, suing Equifax just got easier. But you should think twice before firing up your own legal vendetta.

The DoNotPay chatbot, created by Joshua Browder, is billed as the world’s first “robot lawyer.” It has already been used to help people get out of parking tickets. As the Verge reports, it expanded this week to allow Americans to more easily sue Equifax over the data breach in small claims court.

Damages awarded in small claims courts differ from state to state, with Tennessee offering the highest amount: $25,000. As Browder told the Verge, the goal is to “replace lawyers, and, with enough success, bankrupt Equifax” through a deluge of small claims lawsuits against the company.

Just one thing: Using DoNotPay to sue Equifax may be far more trouble than it’s worth, according to the opinions of legal experts.

“I am not inclined to think it would be a panacea,” Scott Nelson, an attorney with the rights-advocacy group Public Citizen, told the Verge. “Filing and winning a small claims case takes more than just filling in a form.”

Exciting news. You can sue Equifax for up to $25,000 by pressing a button! First case of fully automated lawsuithttps://t.co/cDHUYaVXbu

— Joshua Browder (@jbrowder1) September 12, 2017

The DoNotPay chatbot does not file a lawsuit for you—you’ll still need to go to the court house, pay a filing fee, and arrange to have the lawsuit served to Equifax. Instead, DoNotPay simplifies the process of filling out the necessary forms needed to file the lawsuit.

The strategy behind Browder’s quest to bankrupt Equifax is largely contingent upon the company failing to respond to the lawsuits, which in some states will result in a default settlement. Problem is, Equifax has the ability to respond to these lawsuits in a way that will make life far more difficult for the plaintiffs.

If Equifax responds, “the first thing they will do is file necessary paperwork to remove the case from small claims court, because lawyers may not represent clients in small claims court,” Matthew Sunderlin, a Michigan-based attorney, tells the Daily Dot. “Where it is removed to will depend on several factors, but assuming there are a lot of these things that Equifax has to deal with, they will try to remove all of them to state-level or federal-level court, and consolidate them so they can litigate them all as a group.”

As Sunderlin explains, any substantial response from Equifax would create “reams of paperwork to deal with just to keep the suit alive, let alone to properly pursue a claim.” Further, Equifax’s involvement would mean the involvement of lawyers, which largely defeats the purpose of DoNotPay’s proposition. “No matter what … as soon as Equifax responds, meaning lawyers get involved, any unrepresented individual is basically sunk,” Sunderlin says.

So, let’s say Equifax just ignores all the small claims lawsuits DoNotPay inspires. Plaintiffs can just sit back and wait for the check to arrive, right? Not even close.

In many jurisdictions, plaintiffs must prove that they suffered actual damage as the result of the Equifax hack, which exposed names, home addresses, Social Security numbers.

“What the individual will have to argue is, effectively, Equifax had a duty to protect that individual’s personal information, Equifax failed to uphold that duty, Equifax’s failure caused that person to suffer harm, and that harm is known or discernible,” Sunderlin says.

In his professional opinion, this assertion will be difficult to prove in court. “It is the latter two elements where the argument falls apart,” he says.

To prove your claim that Equifax caused you harm—the basis for your lawsuit—you’d need proof that the information leaked from Equifax actually resulted in harm against you. Considering the seemingly endless stream of major hacks that have taken place in recent years, proving that data used to, say, illegally take out a loan in your name came specifically from Equifax would be difficult if not impossible.

“The mere fact that Equifax leaked your information does not necessarily cause you harm,” says Sunderlin. And even if you were able to prove that data leaked from Equifax caused you harm, you’d then have to make a case for how much money you should be awarded as a result.

Given the wide range of possible outcomes from state to state, it’s plausible that using DoNotPay to help you file a lawsuit could be successful. More likely, however, is the chance that you decide to either drop the lawsuit altogether or find yourself buried under a mountain of legal paperwork from which no chatbot can rescue you.

Rather than going through the trouble of filing a small claims lawsuit yourself, you’re likely better off joining one of the class-action lawsuits against Equifax, which will greatly limit the amount of time and energy required to file your own complaint.

“Unless an individual has a really good set of facts to throw up against everything Equifax can bring to bear, the better option by far is to sign onto the class-action suit,” says Sunderlin. “That option is much closer to the sort of file-and-forget that the chatbot makes itself out to be.”