Tax law is complex, dense, boring—and one of the most important issues facing everyday Americans.

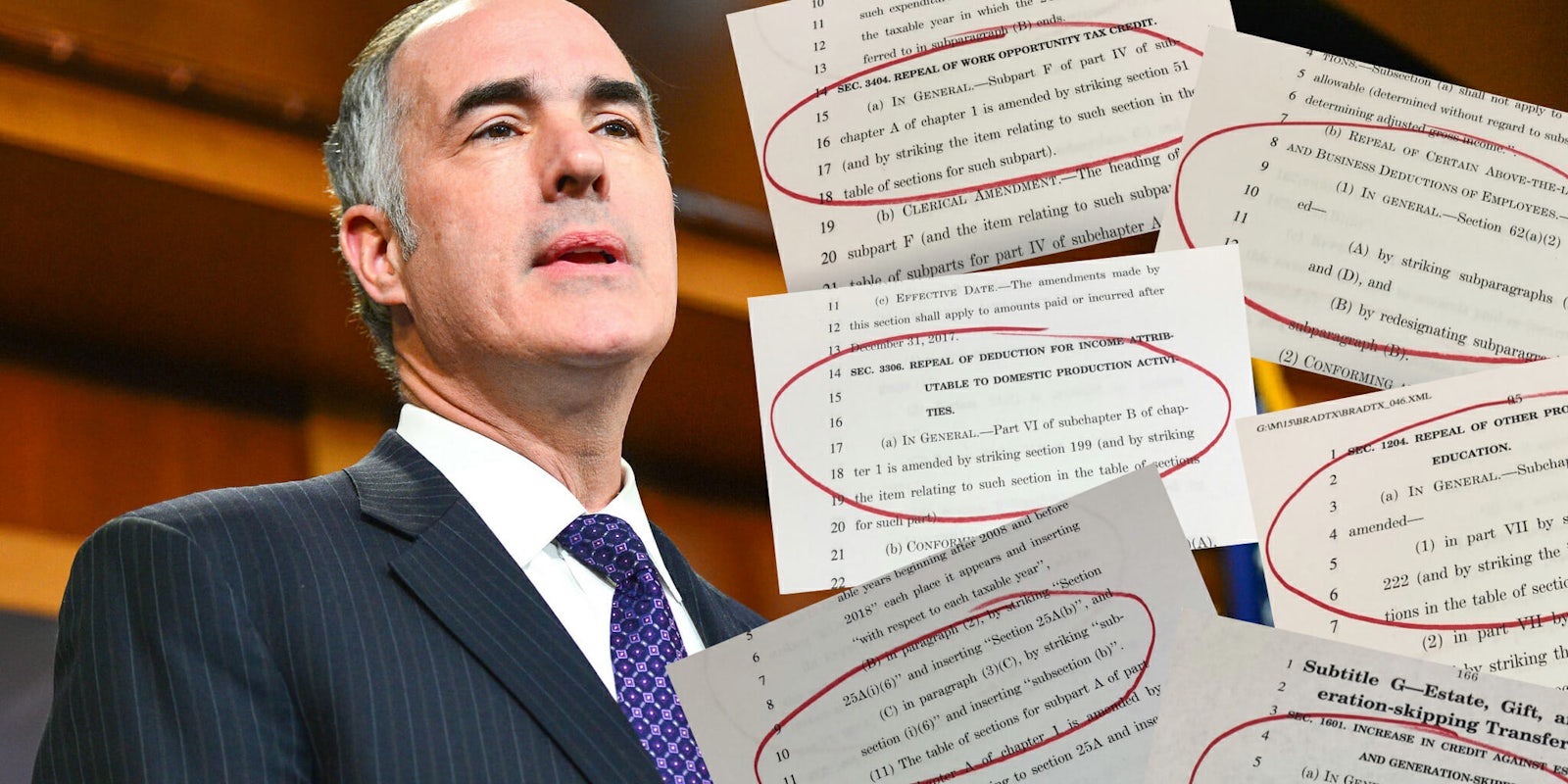

In an attempt to take some of the mystery and labor out of the major tax proposal from House Republicans, Sen. Bob Casey (D-Pa.) is tweeting out all the issues he sees as problematic, based on an assessment of the legislation by the Joint Committee on Taxation (JCT). Casey is focusing entirely on how some Americans will lose out if—or, perhaps more likely, when—the “Tax Cuts and Jobs Act” becomes law.

In case you don’t follow Casey, or simply don’t use Twitter, we’ve collected his relevant tweets below:

Pg 24 Repeals the $4050 (per family member) personal exemption. pic.twitter.com/vWZYaOhiiN

— Senator Bob Casey (@SenBobCasey) November 6, 2017

This means a family of four gains $11,700 in standard deduction and simultaneously loses $16,200 in personal exemptions. JCT expl. Pg 10

— Senator Bob Casey (@SenBobCasey) November 6, 2017

This eliminates the deduction for people with high medical expenses. – JCT explanation pg. 60 pic.twitter.com/MVqjGgJbsy

— Senator Bob Casey (@SenBobCasey) November 6, 2017

Essentially creating a GOP Chronic Care Tax. Why is this bad? Start here: https://t.co/E3ZI11XGLC

— Senator Bob Casey (@SenBobCasey) November 6, 2017

Pg 72. This repeals the Adoption Tax credit making it harder for middle class families to adopt. – JCT explanation pg 26 pic.twitter.com/8pgIEeSgS9

— Senator Bob Casey (@SenBobCasey) November 6, 2017

Pg 135 This is a new moving tax on anyone who has to relocate frequently for work. – JCT explanation pg 61 pic.twitter.com/9Ly9pCh1OB

— Senator Bob Casey (@SenBobCasey) November 6, 2017

This will hit military families particularly hard. https://t.co/WwUEt6cXVR

— Senator Bob Casey (@SenBobCasey) November 6, 2017

Page 103 – This eliminates the deduction for state and local income taxes. pic.twitter.com/j59ple5RFm

— Senator Bob Casey (@SenBobCasey) November 6, 2017

Pg 252 Repeals the Work Opportunity Tax Credit, including for disabled vets and low income families- JCT explanation pg 158 pic.twitter.com/ge3vnUQCFC

— Senator Bob Casey (@SenBobCasey) November 6, 2017

Pg 132 Repeals the $250 above the line deduction for teachers to help offset their out of pocket school supplies. pic.twitter.com/hfU9KO1anO

— Senator Bob Casey (@SenBobCasey) November 6, 2017

The JCT explanation for this is on pg 65 of their description but read this for more: https://t.co/57GRVKMWG0

— Senator Bob Casey (@SenBobCasey) November 6, 2017

Pg 233 eliminates the deduction for domestic manufacturing. – JCT explanation pg 142 pic.twitter.com/uw0VhrR1eU

— Senator Bob Casey (@SenBobCasey) November 6, 2017

This eliminates the above-the-line student loan interest deduction. pic.twitter.com/wj6fkHUEfl

— Senator Bob Casey (@SenBobCasey) November 6, 2017

Current law allows up to a $2,500 deduction against interest paid on student loans.

— Senator Bob Casey (@SenBobCasey) November 6, 2017

These deductions can be taken by anyone paying off their student loans who makes less than $165,000 (married) and $80,000 (single).

— Senator Bob Casey (@SenBobCasey) November 6, 2017

The GOP tax bill eliminates this deduction. See JCT explanation on page 40 of their description https://t.co/fx5JE61lxT

— Senator Bob Casey (@SenBobCasey) November 6, 2017

Striking sec 221 also eliminates the deduction for tuition and other education related expenses – currently allows up to a $4,000 deduction.

— Senator Bob Casey (@SenBobCasey) November 6, 2017

Pg 89 This repeals the Lifetime Learning Credit – a $2,000 Tax Credit for those seeking to acquire or improve job skills. pic.twitter.com/y4o3HeuRqk

— Senator Bob Casey (@SenBobCasey) November 6, 2017

Pg 166 and this is where they double the estate-tax exemption. Unless you’re a millionaire, this does not help you. pic.twitter.com/XV1A5D7WGn

— Senator Bob Casey (@SenBobCasey) November 6, 2017

House GOP’s Child Tax Credit Expansion Excludes Millions of Children in Lower-Income Working Families https://t.co/bkkVKvejEQ

— Senator Bob Casey (@SenBobCasey) November 6, 2017

The tax would be repealed completely starting in 2024, at a cost of $171.5 billion (over 10). JCT explanation Page 100.

— Senator Bob Casey (@SenBobCasey) November 6, 2017

The JCT found that the tax plan would add $1.5 trillion to the national debt and overall provide lower benefits to middle-income Americans than President Donald Trump promised while giving the bulk of the benefits to millionaires and other wealthy Americans.

JCT distributional estimates: Millionaires get 2.2% boost in income without even counting estate tax. Middle class gets far less or nothing. pic.twitter.com/hrWqJOrh32

— Lily Batchelder (@lilybatch) November 3, 2017

That said, whether you’ll pay more or less in taxes under the GOP plan depends upon a wide number of factors, such as whether you have children, whether you own your home (and the size of your mortgage), your state and local tax rates, which tax bracket you or your family would fall into, and more.

Congressional Republicans aim to pass their tax plan before the end of the year. But given the contentious nature of the legislation and the combative attitudes in Congress, nothing is written in stone—at least not yet.