Today the digital currency Bitcoin spiked in value, increasing almost 70 percent in two days. Most analysts credit the ongoing Cyprus banking crisis as forcing the price up. One Bitcoin entrepreneur, however, believes recent actions by the U.S. Department of Treasury has legitimized the currently to a degree that heavy hitters see it as a legitimate investment.

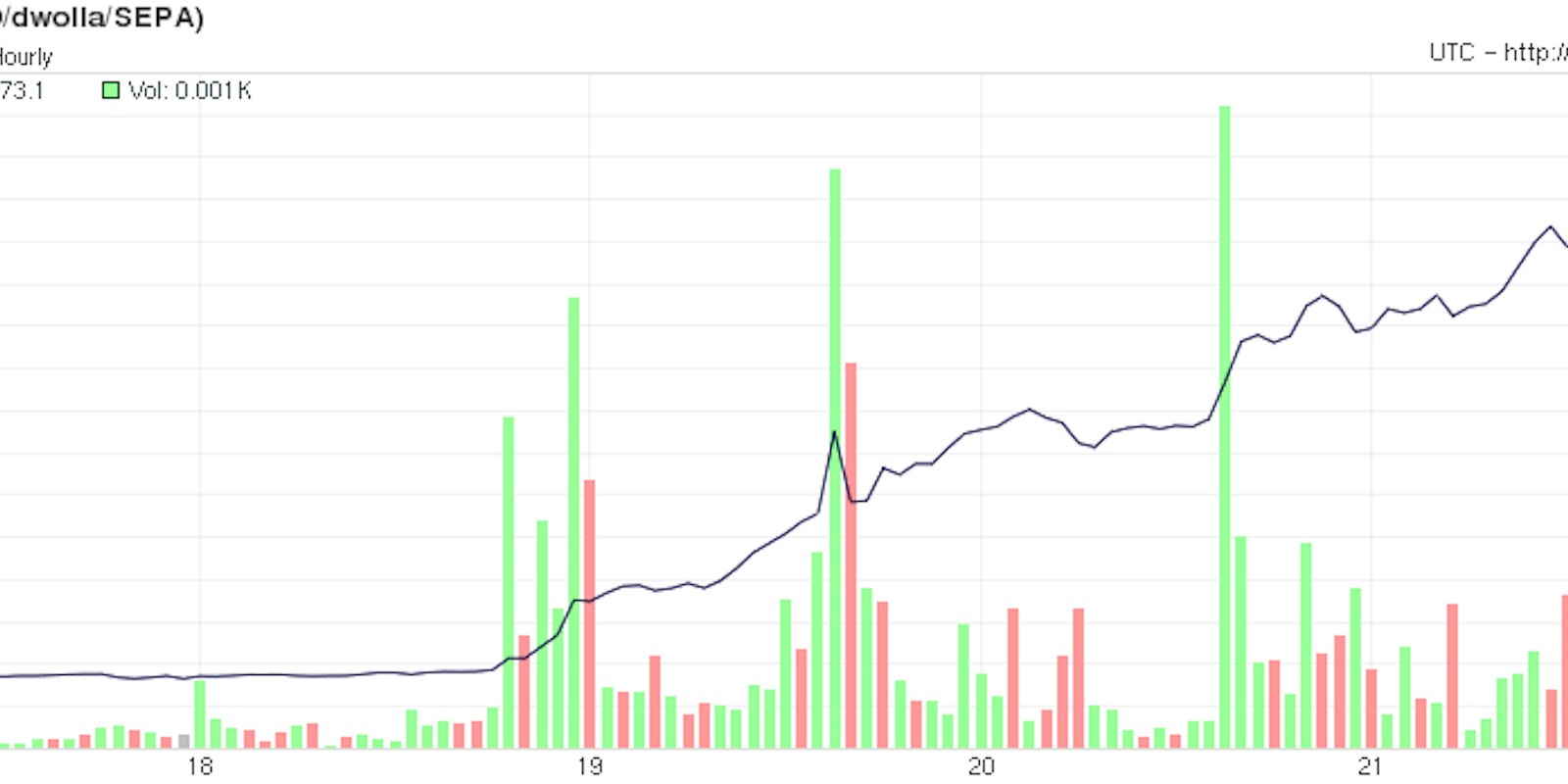

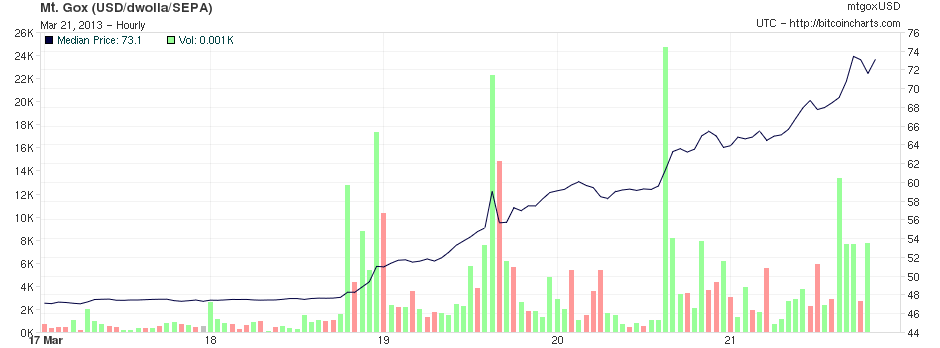

The currency rose from $42 to $72, according to Bitcoin Charts, hitting a high of $74.90, according to Mt. Gox, the largest Bitcoin exchange. It is trading at 145 percent what it was a month ago.

Once relegated to black markets of the Web, Bitcoin is a difficult-to-trace digital currency that does not rely on a government or central bank to be bought or used. It has become increasingly popular, with users employing it to buy everything from pizza to electronics; others have used it to pay their employees or simply as an investment vehicle.

Spain’s economic freefall and Cyprus’s banking emergency seem to be having an effect on the currency, though some analysts feel not enough to justify the rise. Some fear another bubble.

Bloomberg quoted Nick Colas, chief market strategist at ConvergEx Group, as saying, “If you want to get a good sense of the stress European savers are feeling, just watch Bitcoin prices.”

Spain has been in decline for several years, and recently, the European Union has required Cyprus to levy a tax on savings accounts before it will bail out the faltering island nation. Cyprus has rejected the conditions of this bailout, leading to fears of a widespread banking failure.

In Spain three Bitcoin apps—Bitcoin Gold, Bitcoin Ticker and Bitcoin App—have been downloaded at a significantly higher rate than usual, according to Wired. Android Bitcoin apps also appear up. But Colas believes “One hundred percent of (the current spike) is due to Cyprus.”

The banking situation there is so uncertain that Cypriots appear to have reached out toward Bitcoin, which (so far) no government can run into the ground.

This rise may offer material proof that Bitcoin is a true alternative to shaky national currencies and collective currencies, like the euro. This in turn may explain investor’s becoming so suddenly sanguine about its value.

Charlie Shrem, the CEO of BitInstant and vice chairman of the Bitcoin Foundation, disagrees with this analysis.

“Probably has a lot to do with FinCEN ruling!” he told Daily Dot. “People feel a lot better leaving $200-300k of their assets in Bitcoin now that the U.S. Government put in a legal framework.“

FinCen is the U.S. Department of the Treasury’s Financial Crimes Enforcement Network, which is responsible for currency rules and money laundering issues in the United States. The ruling he refers to is the “Application of FinCEN’s Regulations to Persons Administering, Exchanging, or Using Virtual Currencies” (PDF), which FinCen announced March 18.

The rules, according to FinCen, “define certain businesses or individuals as money services businesses (MSBs) depending on the nature of their financial activities. MSBs have registration requirements and a range of anti-money laundering, recordkeeping, and reporting responsibilities under FinCEN’s regulations. The guidance considers the use of virtual currencies from the perspective of several categories within FinCEN’s definition of MSBs.”

In other words, Bitcoins, their use and those who use them, now have a clarified legal status within Treasury regulations. That may have made it less of a gamble and more of an investment.

Given Bitcoin’s repeated boom-and-bust cycle, however, any idea of always up-never down should be put out of mind. As Zachary Seward points out in Quart, “all signs point to a bubble.”

However, if one is investing for the long term, it has, in its admittedly short life, proven to be an overall gainer.

H/T @YourAnonNews | Graph via Bitcoin Charts