Whether you’re looking to save up money for a big move or have realized your daily splurging is more fit for someone with a six-figure income, keeping track of your spending habits is an easy step toward feeling like you kind of have life together.

While managing money once required a flurry of registers, ledgers, bills, and monthly statements, smartphone apps and services have made tracking your bills and finances easier and far less painful.

If you’re immobilized at the thought of facing your financial fate and not sure where to begin, here are the five best apps to help develop a realistic budget and stick to it.

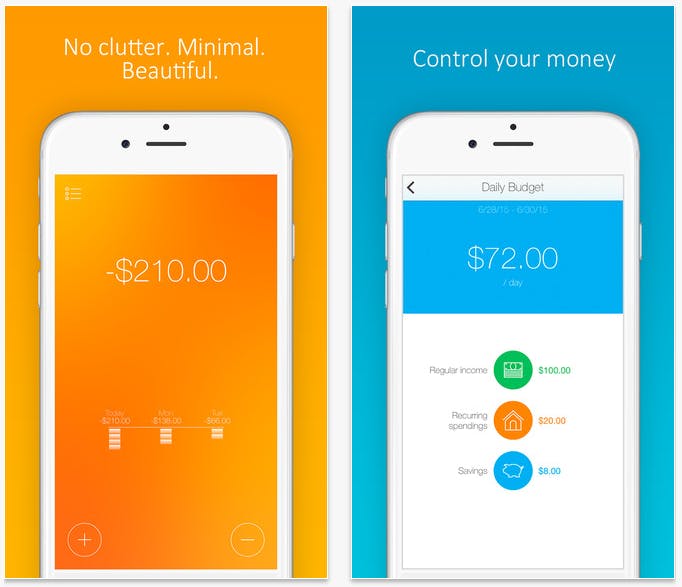

1) Daily Budget

Unlike other apps that automatically track your expenses and notify you when you’re overspent, Daily Budget actually develops your potential budget based off your income and expenditures. From the “Daily Budget” screen, tap in your regular income, your recurring expenditures, and any amount you want to save. The app will calculate the amount of money you get to play with each day.

Read more from the Daily Dot:

For example, if you type that you make $5,000 a month, the app will automatically calculate that you have the ability to spend $166.67 a day until you run out of funds. Then, when you add your recurring payments such as rent, utilities, car payments, or donations, the app recalculates your daily budget. The same is done when you indicate how much you want to save each month.

From the Main Page tab you can also log expenses, add extra income and savings, and decide how long you want to make those extra funds last under Daily Budget’s calculations. While the calculations might be done as easily on paper, Daily Budget is a great way to figure out where to start when deciding a budget for yourself, and doesn’t require a username and password.

Available on iPhone. Android release set for Summer 2016.

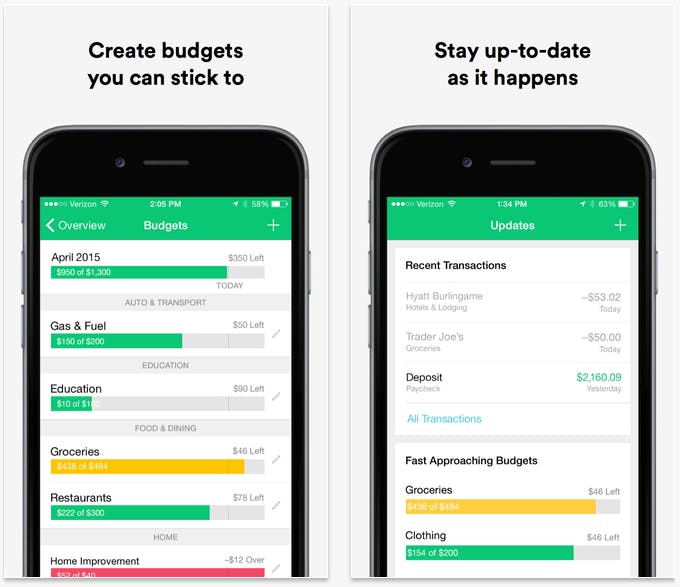

2) Mint

An award-winning phone application by Intuit, Mint tracks spending across bank accounts, investments, and credit cards. It also allows users to set budgets for expenses, receive bill payment reminders, and monitor spending trends. Notably, users can rest easy knowing their stored information is protected by multi-factor authentication and software encryption.

After creating a Mint account, users can link up their banking accounts and cards with their institution’s login information. All transactions on those accounts are then logged and sorted into different budget categories, but can also be sorted and logged manually.

From there, users can tap “Overview” in the navigation on the bottom of the screen, then tap “(This Month’s) Budget” to access and edit different spending maximums. Add a budget by tapping the plus sign in the top right of the screen, or edit a budget by tapping the pencil icon on the right of your desired category.

When you exceed or come close to exceeding a budget, Mint with notify you through the app or via email based on your settings. If you want to change, add, or delete a monitored account, tap Settings in navigation and then Accounts to access the page.

Available on iPhone and Android.

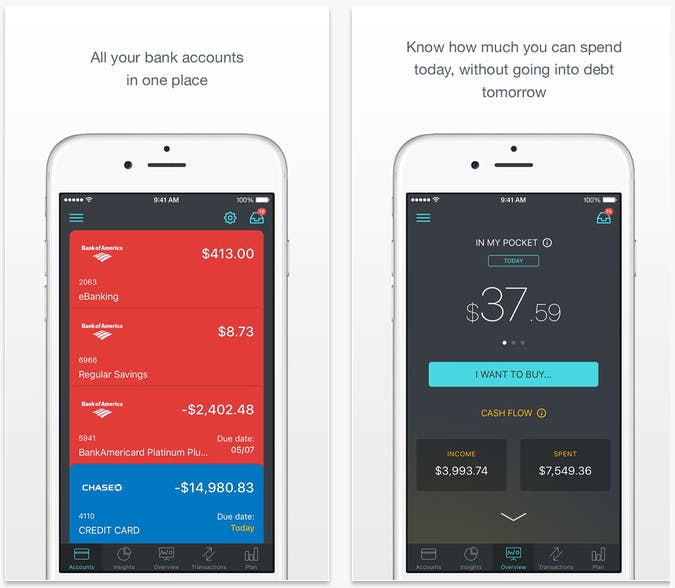

3) PocketGuard

Similar to Mint, PocketGuard allows users to connect their banking accounts and credit cards, but it goes a step further to include applications and services such as Venmo and PayPal, giving a more inclusive look at finances and expenditures. Just like the previous app, users create an account and log into their financial institutions and services with their own separate login information.

PocketGuard then records income via transactions (including paychecks or PayPal cashouts, etc.), asking users to designate which transactions are recurring bills (such as phone bill payments, monthly subscriptions, etc.) and to set a savings goal for the month. All of this information can be accessed by tapping the “Plan” tab in the navigation.

From there, the Overview tab shows the “safe-to-spend amount” for the day, week, and month; the analyzed income versus outcome; and the user’s net worth, which are all calculated from the supplied info on income, bills, and savings goals.

Users can also check spending “Insights” under the navigation menu, which show what percent of their expenditures has gone toward particular categories over the month, such as groceries or entertainment.

Available on iPhone and Android.

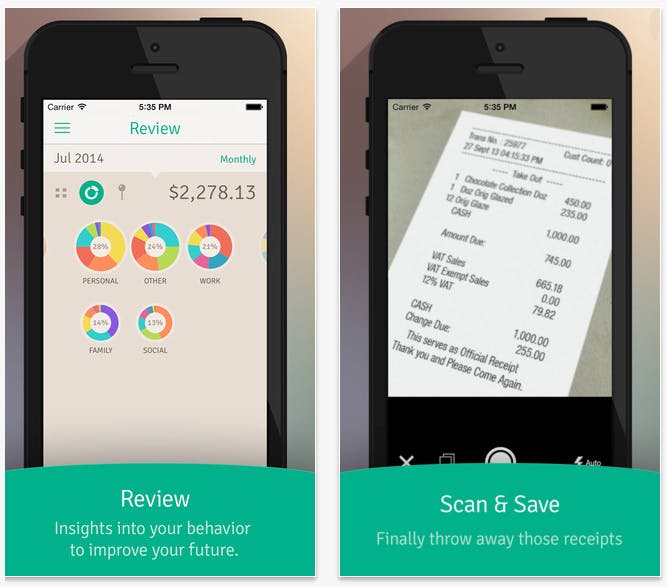

4) Wally

Skeptical penny-pinchers who don’t want to hand over their banking login can try Wally, a personal finance application that allows users to instantly log transactions. After providing the app with a name and email address, the user can enter their monthly income and current bank balance.

Using the monthly income and current balance, Wally calculates the user’s daily allotted budget and remaining budget for the month, which can be seen under the Home tab at the top of the screen.

From there, users can tap the plus sign in the top-right corner to manually add transactions, choosing from various categories under four different topics: “Personal,” “Social,” “Work,” and “Family.” The app advises users to do this right after they make a transaction so they don’t forget, though purchases can be backlogged by selecting a different date and time during the logging process.

When logging the transaction, the app detects the user’s location and suggests surrounding venues or websites the purchase could have been made from. If a transaction is recurring, tap the rotating arrows icon next to “Add a note,” and enter in the transaction frequency (weekly, monthly, etc.). Users can also take photos of their receipts through the app and use them to log transactions automatically.

Since the app requires users to log their transactions manually, Wally provides users some additional clarity about everyday expenditures and how close they are to spending limit versus if they were using an automated logging application, making this app fit for serious budget sticklers.

Available on iPhone and Android.

5) Level Money

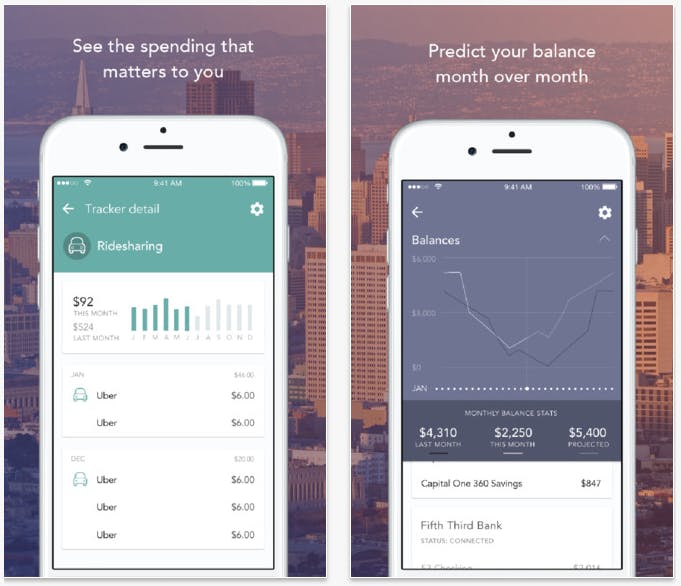

Though Level Money allows users to log into their financial institutions in the same manner as Mint and PocketGuard, this app is different in that it allows users to review these transactions through a coded timeline.

Instead of setting a max amount on certain types of purchases like coffee or entertainment, users can instead create intuitive “trackers” for these categories and mark certain purchases from previous transactions that fall under the tracker.

Once a user logs into their financial institution, they can pick bills from their previous transactions and set them as examples of future recurring expenses. Users can also do same with previous income as examples of recurring income.

The app also gives users a rundown of their “Spendable,” which is the money they’re able to spend after monthly essentials like bills, and helps the user adjust the spendable based on preexisting spending habits.

Level money also projects next month’s balance and spending based off of the user’s current spending habits. While the app isn’t as comprehensive as Mint and PocketGuard, it allows users to ease into financial responsibility instead of overwhelming them with strict spending limits and an inundation of notifications.

Available on iPhone and Android.

Looking for free financial advice? Be sure to check out our guides on YouTube channels that will help balance your budget and the best apps for tax season.