About 800,000 people received inaccurate tax information from the government after enrolling in insurance policies through HealthCare.gov.

Based on their projected income, millions of citizens were set to receive tax credits to help pay insurance premiums. Those who failed to purchase health insurance last year will face penalties under the new healthcare law.

Officials said they were not currently aware of why so many had received false information related to premiums on their taxpayer forms, the New York Times reported.

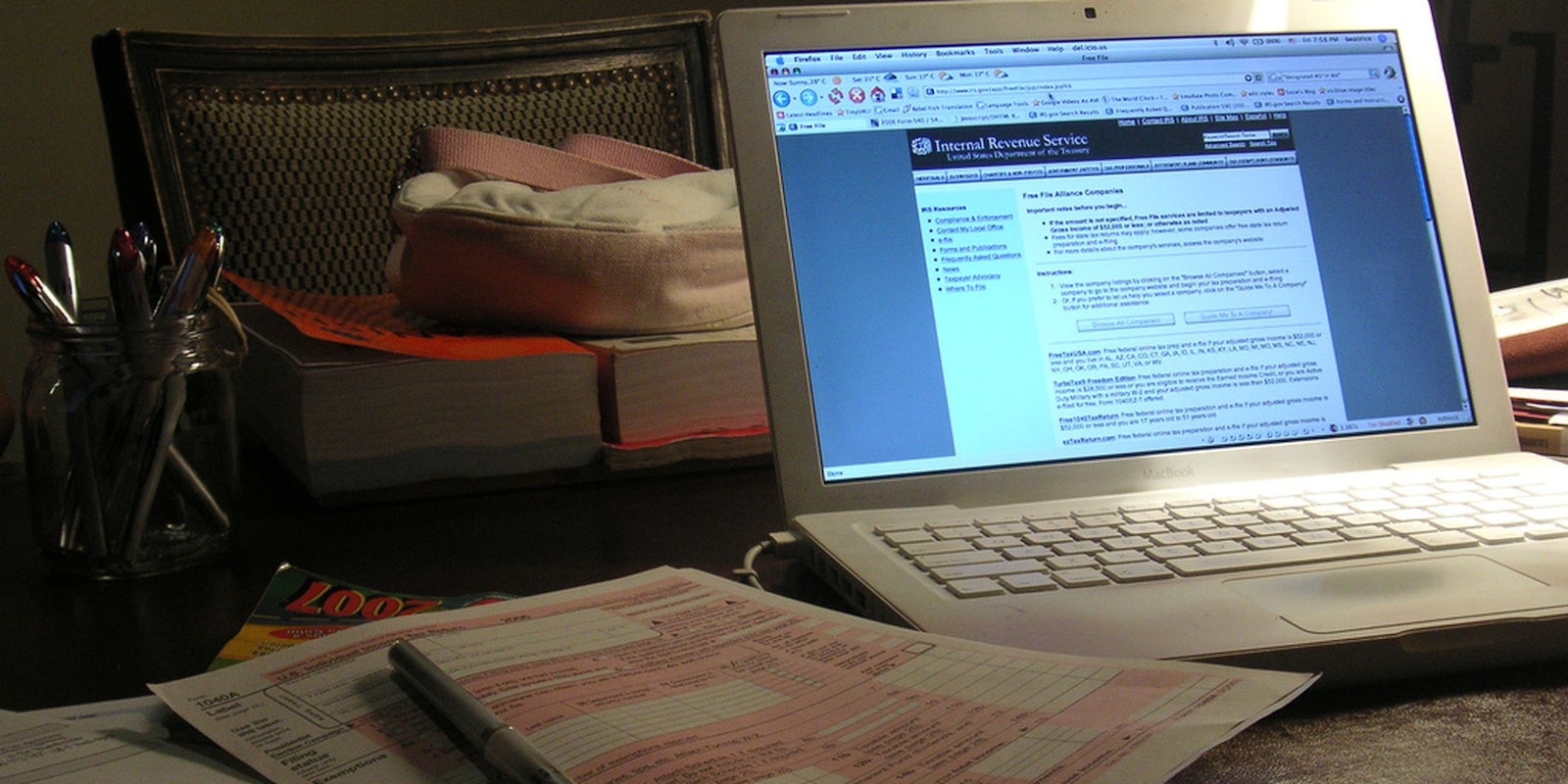

The error is said to have occurred in about one-fifth of all forms, known as 1095-As, mailed out by the federal government. The issue, according to top White House officials, is related to the way “benchmark” premiums were calculated, which is used to determine the amount of subsidies individuals receive. It’s similar to what would happen if an employer reported false information on wages paid to an employee.

President Obama announced this week that 11.4 million people had selected private health insurance plans or renewed their coverage under the Affordable Care Act. For the most part, the HealthCare.gov website, which was laden with technical issues during its 2013 launch, has operated smoothly over the past year. With this error, however, nearly 1 million people may have to wait longer this year to get their income tax refunds.

Government officials announced a special extension on Friday that will give uninsured people additional time to sign up for subsidized coverage through HealthCare.gov. The grace period, which is not expected to recur next year, will begin March 15 and end April 30.

Consumers will receive a corrected form during the first week of March, officials said. They warned that some taxpayers will end up owing more, while others will owe less.

H/T New York Times | Photo by Beatrice Murch/Flickr (CC BY 2.0)