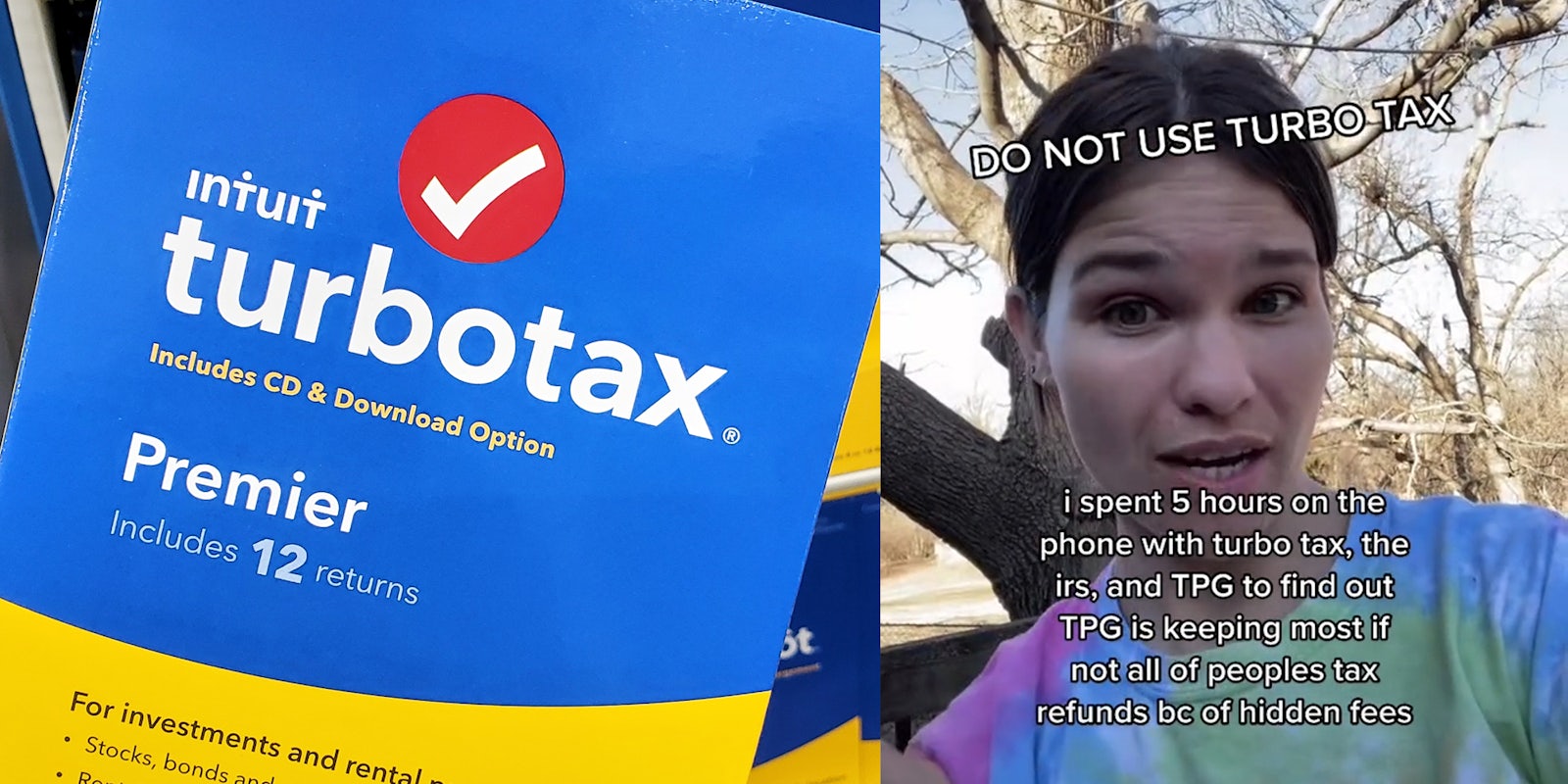

A TikToker is calling out TurboTax and the third-party vendor it works with, Santa Barbara Tax Products Group (TPG), for hidden fees that took allegedly thousands from her tax return.

In the TikTok, posted by Micah Russell (@happyspell), the text overlay reads: “I spent 5 hours on the phone with turbo tax, the irs and TPG to find out TPG is keeping most if not all of peoples tax refunds bc of hidden fees.”

In the clip, Russell says, “I got my tax return today and I filed with TurboTax. The option that I filed with was 21 days, normal, hit my bank account in 21 days. It took over a month to hit my bank account. That’s not the issue.”

She further claimed: “The issue is when it did hit my bank account, it was less than a third of what should have been, less than a third than what the IRS said would be my tax return.”

She says she called TurboTax and they told her to call the IRS and that “there’s nothing they can do.” She ends up on an automated call with the IRS department that handles offsets. Offsets are when you actually owe the IRS money, like through student loan debt, and so to make up for that debt, the IRS takes money from your tax return.

Russell says she has no offsets so “there was really no reason for TurboTax to take over 3,000 of my tax return.”

She says she started researching online and found a forum where other people are experiencing the same issue of not getting their full tax return while not having an offsets.

As of Thursday, Russell’s TikTok has over 64,000 views.

“The turboTax representatives have been friendly but they were very vague and offered no help other than give the phone numbers of the treasury offset department and TPG,” Russell tells The Daily Dot.

“I’ve talked to everyone, TPG, IRS, TurboTax, Internal Revenue, Debt Management, Intuit, Bureau of Fiscal Service etc.,” she says.

On the TurboTax Discussions webpage, there are multiple posts about people experiencing similar issues. There are also hundreds of complaints on the Better Business Bureau against TPG.

TurboTax has been sued over its hidden fees before. In 2021, there was a class-action settlement against Intuit, which is the financial software company that owns TurboTax, for saying low-income and active military could use the tax-filing service for free. Instead, the plaintiffs said they ended up paying $100 a year. A federal judge rejected the proposed $40 million settlement because each customer would only receive about $28, which he said was “not fair.”

In later TikToks, Russell said some “TurboTax specialists” were looking into her and other people’s issues to get them their full deposit.

As of Thursday, Russell tells the Daily Dot that the issue remains unresolved.

“I decided to share my experience because I am part of a forum of over one thousand people who this is happening to,” she says in the email to the Daily Dot. “People who have zero offsets, who the IRS say should have their full refund, who have tried their hardest to get answers to no avail. This type of thing gets swept under the rug and I wanted people to know that they aren’t alone and that others are actively trying to set things straight.”

The Daily Dot has reached out to Intuit via email.

Today’s top stories

| ‘Fill her up’: Bartender gives woman a glass of water when the man she’s with orders tequila shot |

| ‘I don’t think my store has even sold one’: Whataburger employees take picture with first customer who bought a burger box |

| ‘It was a template used by anyone in the company’: Travel agent’s ‘condescending’ out-of-office email reply sparks debate |

| Sign up to receive the Daily Dot’s Internet Insider newsletter for urgent news from the frontline of online. |